| Type of paper: | Essay |

| Categories: | Law Tax system |

| Pages: | 4 |

| Wordcount: | 913 words |

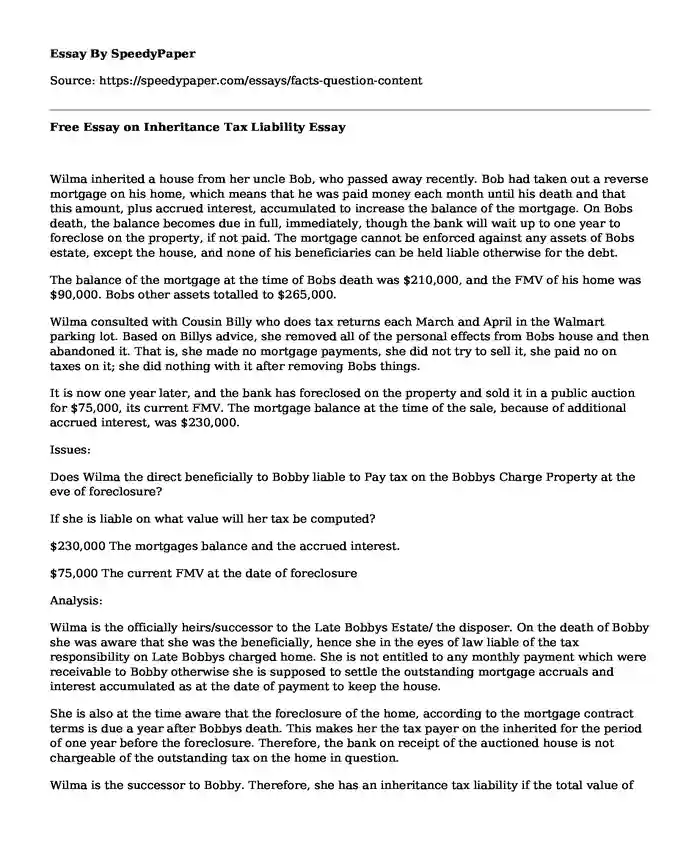

Wilma inherited a house from her uncle Bob, who passed away recently. Bob had taken out a reverse mortgage on his home, which means that he was paid money each month until his death and that this amount, plus accrued interest, accumulated to increase the balance of the mortgage. On Bobs death, the balance becomes due in full, immediately, though the bank will wait up to one year to foreclose on the property, if not paid. The mortgage cannot be enforced against any assets of Bobs estate, except the house, and none of his beneficiaries can be held liable otherwise for the debt.

The balance of the mortgage at the time of Bobs death was $210,000, and the FMV of his home was $90,000. Bobs other assets totalled to $265,000.

Wilma consulted with Cousin Billy who does tax returns each March and April in the Walmart parking lot. Based on Billys advice, she removed all of the personal effects from Bobs house and then abandoned it. That is, she made no mortgage payments, she did not try to sell it, she paid no on taxes on it; she did nothing with it after removing Bobs things.

It is now one year later, and the bank has foreclosed on the property and sold it in a public auction for $75,000, its current FMV. The mortgage balance at the time of the sale, because of additional accrued interest, was $230,000.

Issues:

Does Wilma the direct beneficially to Bobby liable to Pay tax on the Bobbys Charge Property at the eve of foreclosure?

If she is liable on what value will her tax be computed?

$230,000 The mortgages balance and the accrued interest.

$75,000 The current FMV at the date of foreclosure

Analysis:

Wilma is the officially heirs/successor to the Late Bobbys Estate/ the disposer. On the death of Bobby she was aware that she was the beneficially, hence she in the eyes of law liable of the tax responsibility on Late Bobbys charged home. She is not entitled to any monthly payment which were receivable to Bobby otherwise she is supposed to settle the outstanding mortgage accruals and interest accumulated as at the date of payment to keep the house.

She is also at the time aware that the foreclosure of the home, according to the mortgage contract terms is due a year after Bobbys death. This makes her the tax payer on the inherited for the period of one year before the foreclosure. Therefore, the bank on receipt of the auctioned house is not chargeable of the outstanding tax on the home in question.

Wilma is the successor to Bobby. Therefore, she has an inheritance tax liability if the total value of all the inherited properties/ estate exceeds the inheritance tax free threshold. There are exceptions to the inheritance tax which are:

Inheritances taken by a spouse or civil partner.

Inheritance taken by a qualifying cohabitant by court order.

Inheritance for public or charitable purposes.

Inheritance of a dwelling house.

Evaluating the listed exceptions Wilma has an inheritance tax liability not filed, due to the federal revenue department. The value of the inheritance tax is determined on the following:

According to IRS publication 551(2014)

The basis of property inherited from a decedent is generally on the following:

The FMV of the property at the date of the individuals death.

The FMV on the alternative valuation date if the personal representative for the estate chooses to use alternative valuation.

The value under the special- use valuation method for real property used in farming or closely held business if chosen for estate tax purpose

The decedents adjusted basis in land to the extent of the value excluded from the decedents taxable estate as a qualified conservation

If a federal estate tax does not have to be filed, your basis in the inherited Property is its appraised value at the date of death for state inheritance or transmission taxes.

Is Wilma supposed to file the property file the monthly estate property?

The inherited home with a Market value of $ 90,000 is charged to a mortgage valued at $210, 000, a year later the bank forecloses on the home and realizes $ 70,000. The tax payer in this case is Wilma the successor. The issue is the value on which she will file her estate tax. According to the case of Crane v Commissioner the net value realized over the value of the debt is taxable. It this case the amount realized by the bank/purchaser is $70,000, which is matched to $230,000 of the FMV. This results to an adverse realization, in the eyes of the court the mortgagee has gained. The inherited home is not an appreciated inherited property hence Wilma estate tax assessable is the difference between $230,000 and $70,000. The value her estate tax is assessed is $160,000. Reference to the case of Tuft and Commissioner ruling

Reference to the Crane v Revenue Commissioner

Conclusion

Wilma has an inheritance tax for the receipt of her uncles estate. Because she is not in the exception spectrum according to the IRS publication 551(2014)

According to the estate tax, she is obliged to file her taxes on the property she inherited from late Uncle Bobby. However, reference to the Crane and Revenue Commissioner. The terms of the mortgage are that it is nonrecourse. Therefore the bank gets to walk away with $70,000 realised value to settle the $230,000 outstanding debt of the mortgage.

Wilma assessed estate tax is $160,000

References

Commissioner V. Tufts (Argued Nov 29th, 1982 decided on May 2, 1983)

Crane V. Commissioner (Argued Dec 11, 1946. Decided April 14, 1947)

Cite this page

Free Essay on Inheritance Tax Liability. (2019, May 15). Retrieved from https://speedypaper.com/essays/facts-question-content

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay Sample on Heroin Effects

- Free Essay on the Movie Fight Club Research

- Learning from the Past to Better the Future: Toxic Leadership Essay Example

- Jonathan Vogel's Argument Against "Moorean's View"

- Ethics Code - HRM Essay Example

- Essay Example Reviewing PR-Related Articles

- Essay Sample on Bach's Toccata and Fugue in D Minor

Popular categories