| Type of paper: | Essay |

| Categories: | Finance |

| Pages: | 6 |

| Wordcount: | 1486 words |

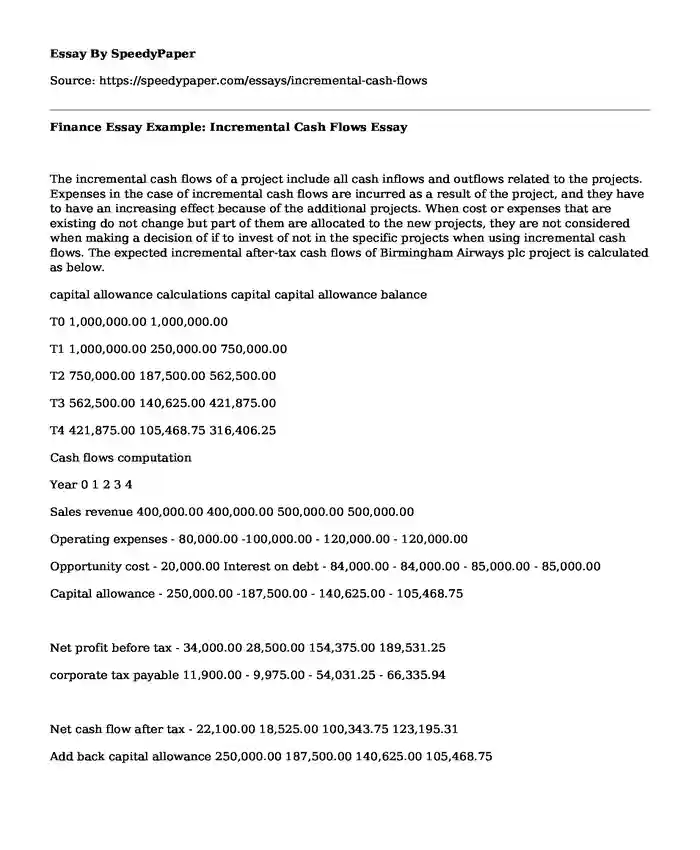

The incremental cash flows of a project include all cash inflows and outflows related to the projects. Expenses in the case of incremental cash flows are incurred as a result of the project, and they have to have an increasing effect because of the additional projects. When cost or expenses that are existing do not change but part of them are allocated to the new projects, they are not considered when making a decision of if to invest of not in the specific projects when using incremental cash flows. The expected incremental after-tax cash flows of Birmingham Airways plc project is calculated as below.

capital allowance calculations capital capital allowance balance

T0 1,000,000.00 1,000,000.00

T1 1,000,000.00 250,000.00 750,000.00

T2 750,000.00 187,500.00 562,500.00

T3 562,500.00 140,625.00 421,875.00

T4 421,875.00 105,468.75 316,406.25

Cash flows computation

Year 0 1 2 3 4

Sales revenue 400,000.00 400,000.00 500,000.00 500,000.00

Operating expenses - 80,000.00 -100,000.00 - 120,000.00 - 120,000.00

Opportunity cost - 20,000.00 Interest on debt - 84,000.00 - 84,000.00 - 85,000.00 - 85,000.00

Capital allowance - 250,000.00 -187,500.00 - 140,625.00 - 105,468.75

Net profit before tax - 34,000.00 28,500.00 154,375.00 189,531.25

corporate tax payable 11,900.00 - 9,975.00 - 54,031.25 - 66,335.94

Net cash flow after tax - 22,100.00 18,525.00 100,343.75 123,195.31

Add back capital allowance 250,000.00 187,500.00 140,625.00 105,468.75

Annual cash flows 227,900.00 206,025.00 240,968.75 228,664.06

Termination cash flows Change in Working Capital - 40,000.00 - 40,000.00 - 50,000.00 - 50,000.00

Salvage Value 20,000.00

Tax on Salvage Value - 7,000.00

Tax for loss on capital disposal 103,742.19

Total Termination Cash Flow - 40,000.00 - 40,000.00 - 50,000.00 66,742.19

Total Initial Outlay - 1,000,000.00 Annual cash flow 227,900.00 206,025.00 240,968.75 228,664.06

Total Termination Cash Flow - 40,000.00 - 40,000.00 - 50,000.00 66,742.19

Total incremental cash flows - 1,000,000.00 187,900.00 166,025.00 190,968.75 295,406.25

The NPV of the project is calculated as

CF1/ (1 + r) ^ 1+ CF2 / (1 + r) ^ 2 + CF3 / (1 + r) ^ 3 + CF1 / (1 + r) ^ 4 I0 as shown below

Year Cash flow Discounting factor Discounting factor Discounted cash flow

0 - 1,000,000.00 (1+0.145)^0 1 - 1,000,000.00

1 187,900.00 (1+0.145)^1 0.873362445 164,104.80

2 166,025.00 (1+0.145)^2 0.762761961 126,637.55

3 190,968.75 (1+0.145)^3 0.666167652 127,217.20

4 295,406.25 (1+0.145)^4 0.581805809 171,869.07

NPV - 410,171.37

The capital for the project is provided by debt holders and the equity holders and, therefore, the discounting factor is equal to the working average cost of capital. It was calculated as below.

WACC = Kd (D / D + E) + Ke (E / D + E)

WACC = 10 % (1 / 2) + 19 % (1 / 2) = 14.5 %

From the above calculations, the incremental after-tax cash flows are calculated from cost and income values of figures that change as a result of the installation of the project. The sales revenues will be incurred when the project is installed. Failure to have the project would not generate the sales revenues. Therefore, the sales are used to coming up of the incremental cash flows. Likewise, the operating expenses and interest on the debt are directly associated with the project. The two expenses would not exist without the project, and they change with the variations in the projects. Also, they were not incurred before the projects were installed and failure to have the projects would lead to the end of the expenses.

Capital allowance is allowable for tax purposes and leads to reduces tax liability. The amount of capital allowance in this project was calculated on a reducing balance. Since the project has a value of 1,000,000, the amount of capital allowance in the initial year would result from the total project value. Once in the subsequent years, the balance of the capital allowance reduces as a result of the reduction of the project written down value. In the fourth year, the project is expected to have a written down value of 316,406.25, but it has a residual value of 20,000. The amount shows a loss in the disposal of the project hence the company is entitled to tax credit because of the loss (35 % * 316, 406.25 -20,000 = 103,742.19). The amount of the residual asset value, however, attracts tax as it is treated as capital gain. After calculating some taxable cash flows and applying the relevant tax values, the total amount of capital allowance is added back because it does not represent any actual cash outflows. It is used in the calculation of the incremental cash flows for tax purposes only.

The project uses equipment in the first year of a project that has already been completed. The equipment would have been leased to generate 20,000. Therefore, in the first year, if the project is implemented, Birmingham Airways plc have an opportunity cost resulting from the lost income if the project was not applied, and hence the inclusion of the opportunity cost in the coming up off incremental cash flows. The opportunity cost should be considered in the determination of if to reject or accept a new project because the income flow that fails because of implementing the new project shows is a relevant cost in the decision making.

The advertising cost would not be used in the calculation of the incremental after-tax cash flows because it is an irrelevant cost in decision making. The companys advertising cost would not change because of the implementation of the new project. The cost of advertisement would remain the same even if they decided against the implementation of the project and, hence, the cost becoming irrelevant in decision making. Therefore, the advertising cost is omitted from the calculation of the incremental cash flows (Gitman, Juchau and Flanagan, 2015, p. 406). Likewise, the research and development that was carried out for so the statement income estimation can be done are ignored in the coming of the incremental cash flows. The costs are sunk and hence they would not influence the decision of rejecting o accepting the project since they are irrelevant. The company has a fixed cost of research and development that is allocated to projects. The 2 % annual allocation of the 3 million research and development cost is also omitted from the calculation of the incremental cash flows because even if the project is not implementing the gross research and development cost will remain the same. Hence in the computation of the after-tax incremental cash flows, the cost that changes from the initial ones as a result of the implementation of the projects are considered.

The estimated values of before tax and after tax cash flows are also not considered in the coming up of the incremental cash flows. The decision of the accepting or rejecting the project depends on the change in income and expenses resulting from the projects, since of the expenses and income considered to be resulting from the projects are presented, the incremental cash flows results from the projection of the expenses and income and not the estimated profits. The discounting factor used in the determination of the present value of cash flows is equivalent to the weighted average cost of capital of the project (Gitman, Juchau and Flanagan, 2015, p. 386). Since the project is financed using two sources of capital, debt, and equity, the WACC is calculated by considering the two expected earning of the capital providers.

The change in the working capital shows cash outflows to purchase short-term asset mostly inventory. The amount used to purchase the inventory does not lead to a reduction of tax payable. Hence, the working capital in the calculation of the incremental after-tax cash flow is considered after cash flows after tax is calculated. It is considered as part of termination cost for the project because once a project comes to an end, they can be disposed to generate some cash flows.

The NPV of the projects if - 410,171.37, therefore, it is advisable to ejects the project because it has a negative NPV. According to the NPV rule, a project that has negative total present values should be ejected regardless of the size of the negative figure.

Calculation of IRR

Internal Rate of Return is the rate at which a project generates zero net present value. At this point, an investor is indifferent if to accept or reject the projects. A rate below the IRR would lead to a positive NPV, and hence, the project is acceptable to the investors. IRR is calculated using the trial method as where; one first estimates a positive NPV and a negative NPV ((Seneviratne, 2007, p. 233). The estimated NPV should be near to zero as possible it is calculated as shown below.

IRR = lower discounting rate + (NPV of the lower discount rate / absolute sum of the NPVs) * difference between the discount rates

Assuming a discounting rate of 2 %

Year cash flows discounting factor discounting factor discounted cash flow

0 - 1,000,000.00 (1+0.02)^0 1 - 1,000,000.00

1 187,900.00 (1+0.02)^1 0.980392157 184,215.69

2 166,025.00 (1+0.02)^2 0.961168781 159,578.05

3 190,968.75 (1+0.02)^3 0.942322335 179,954.12

4 295,406.25 (1+0.02)^4 0.923845426 272,909.71

NPV - 203,342.44

Assuming a discount rate of -7 %

Year Cash flows discounting factor discounting factor discounted cash flow

0 - 1,000,000.00 (1- 0.07)^0 1 - 1,000,000.00

1 187,900.00 (1- 0.07)^1 1.075268817 202,043.01

2 166,025.00 (1- 0.07)^2 1.156203029 191,958.61

3 190,968.75 (1- 0.07)^3 1.243229064 237,417.90

4 295,406.25 (1- 0.07)^4 1.336805445 394,900.68

NPV 26,320.20

IRR = - 7% + 26,320.20/229,662.64 *9 = -5.968566139 = - 6 %

Therefore, the IRR is approximately 6 %

Payback period

The payback period from a project with uneven annual cash flows like the Birmingham Airways plc, is calculated by taking the cumulative net cash flows and determining the amount that adds up to suppress the initial capital outlay. The shorter the payback period, the better the project is assumed because of the uncertainties associated with earning especially after a long period. The payback period of the projects is calculated as below. The IRR is negative and below the expectation of the investors, hence it is advisable to reject the project.

Payback period Year Net cash flow Cumulative cash flows

0 - 1,000,000.00 - 1,000,000.00

1 187,900.00 - 812,100.00

2 166,025.00 - 646,075.00

3 190,968.75 - 455,106.25

4 295,406.25 - 159,700.00

The project had a payback period of more than four years. By the end of the four years, the project has a defici...

Cite this page

Finance Essay Example: Incremental Cash Flows. (2019, Oct 04). Retrieved from https://speedypaper.com/essays/incremental-cash-flows

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Example with Summary of Next-Generations Firewalls for Dummies

- SWOT Analysis of Booz Allen Hamilton Incorporation - Free Essay

- Finance Essay Sample on Return on Investment

- Pow and Article Response, Free Essay in Statistics

- When One Has Lived a Long Time Alone - Poetry Analysis Essay Sample

- Free Essay Describing Ethical Dilemmas in Psychology

- Introduction to Terrorism and Homeland Security, Essay Sample for Free

Popular categories