| Type of paper: | Essay |

| Categories: | Economics |

| Pages: | 5 |

| Wordcount: | 1156 words |

China has slow economic growth according to the US perspective. The US has therefore developed an argument on the same that it has been the actual cause of the financial crisis that had been once experienced in the country. The US, therefore, has emerged to develop criticism on the economic aspects of the country, China, considering its development issues. The decelerating growth of China’s economy has been as issue of concern and which has reached the media at the global. The US, however, appears to be in the lead, as a force posing criticism on this aspect facing China. The U.S companies, however, notices a potential for improvement should the Chinese middle make some significant steps. But the current perspective of the U.S. companies is that their economy has registered some failures. This paper develops a literature summary of “how bad China is from the perspectives of the U.S. Companies?”

Summary Statements

• China’s Gross Domestic Product (GDP) significantly dropped from an annual growth rate of 10% of 1980-2010 to 8% when that of 2011-2014 was announced.

• The whole world, besides the U.S. companies, has noticed the significant drop in China’s economy since it had always been, in the past, among the most developed

• The current technological advancement is still low however the U.S. Companies analyze their situation and predict some considerable development shortly.

• China had an impressive development in its economy with world-class companies, so it was a surprise for the U.S. Companies to see it diminishing in the recent past.

• The U.S. Companies recognizes China’s progress of development in the past therefore finally comment that it has a potential achieving its previous status.

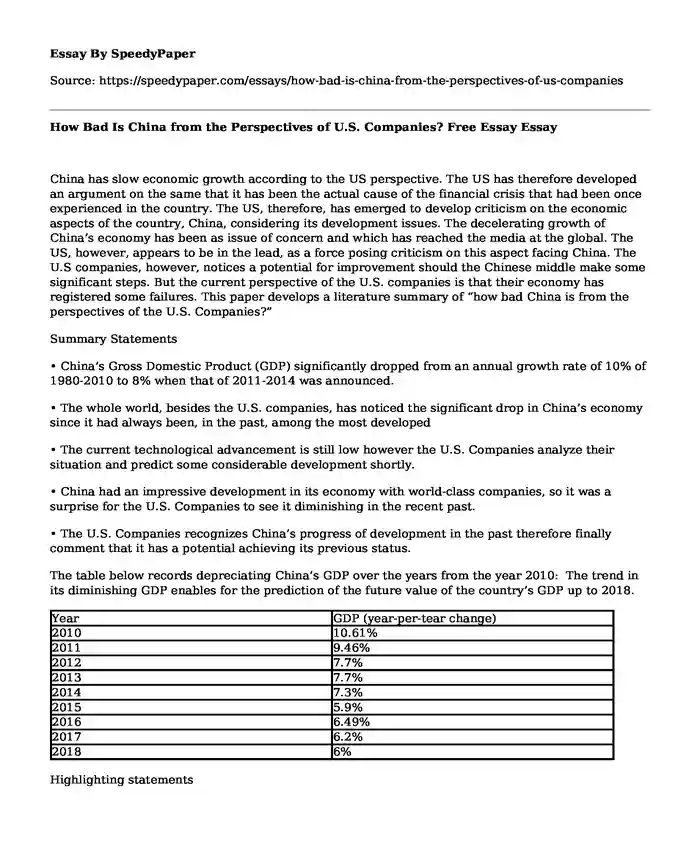

The table below records depreciating China’s GDP over the years from the year 2010: The trend in its diminishing GDP enables for the prediction of the future value of the country’s GDP up to 2018.

| Year | GDP (year-per-tear change) |

| 2010 | 10.61% |

| 2011 | 9.46% |

| 2012 | 7.7% |

| 2013 | 7.7% |

| 2014 | 7.3% |

| 2015 | 5.9% |

| 2016 | 6.49% |

| 2017 | 6.2% |

| 2018 | 6% |

Highlighting statements

• The drop in China’s Gross Domestic Product (GDP): China’s economy registered the significant decline in its GDP which was noticeable to the whole. This was an important issue which the U.S. Companies showed interest to address. The Chinese economy had a GDP of 10% growth rate over the period of 1980-2010. However when within the period of 2011-2014 the announcement revealed a drop to 8%.

• China was in the past one of the countries which had the most developed economies. However, presently, it has registered a considerable decrease. Therefore, the U.S. companies fear for it in the future. A study of statistics on the same view China to be recording a GDP as low as 6%.

• The past of the economy of China has been associated with a positive progress, however; the present drop is dramatic enough. It has surprised many in the whole world. The US companies keenly consider their potential for the development aspects and recognize that it can improve and attain their previous level of economic development.

• China has quite some world-class companies most of which still enable the economy settle at a bearable level. These still let it fall into the category of the most developed countries. Such companies include Qualcomm, Starbucks, Apple and Exxon Mobil.

• The U.S. Companies notes that China has opportunities for improvements should it steps in some aspects of development. It would have, achieved the previous status, as it was in the late 20th century.

The table shows China’s current companies and their contribution to the country. The information communicated in the table indicates that it's potential can enable it to improve once more.

| Company | Product | Contribution |

| Qualcomm | Mobile | The company had achieved 15.5 billion shipments which translate to 13% more than the previous. The mobile technology company has also established a solid market. Therefore, it works towards improving the country's economy |

| Starbucks | Coffee | The company released its earning in the year 2016 which confirmed development in China’s economy. It has a steady allocation of 10 stores per week with 200 locations in the country. |

| Apple | iPhone | The iPhone is the most selling product of the phone technology. Its sale help boosts China's economy. China, therefore, have positive future. |

| Exxon Mobil | Energy | The Exxon Mobil Company has enabled the country to achieve an increased in profit to 63% by the year 2015. |

Discussion on What the Findings Mean

The U.S. Companies came up with positive views following the China’s financial crisis due to their slow development. The fate of the China’s economic progress is determined by the effort of the middle class who can substantially solve the financial crisis. China had important development concepts over the years up to the recent past. During the period, it was among the most developed countries. It also had considerably high GDP up to a late 20th century and extended up to the early 21st century. China has recently recorded a dramatic drop in the financial status. The overall implication has been a subsequent decline in the country's GDP hence it barely falls among the developed countries.

However, a study on china's current investments in the domestic companies shows that it has the potential of growing once more. It has quite some world-class companies like the Apple iPhone, Exxon Mobil, Starbucks and Qualcomm which have up to the recent past contributed significantly to the development of the country’s economy. The U.S. companies have a reason to criticize China’s dying economy but at the same time, predicts that they can make it to a better level should they take advantage of the available opportunities. The analysis of the China’ economy by the U.S. Companies highlights some areas which stand to offer China opportunities for improvements.

China’s economy is fast depleting considering the statistics of the GDP it has recorded from the recent past. Analysis of the recent studies reveals fear for the China’s economy. The study relied on the figures recorded based on the decreasing BDP over the years. The diminishing values of the GDP enable a trend for the prediction of what the future would be. The studies and the subsequent analysis reveal that the China’s economy would finally record an annual GDP of 6%. This will have been the figure ever recorded the least in its history. In conclusion, China is currently experiencing financial constraints, but the U.S. analysis proves that it can make it a better economy.

References

Aldrich, J., Lu, J., & Kang, L. (2014). How Do Americans View the Rising China?. Journal Of Contemporary China, 24(92), 203-221. http://dx.doi.org/10.1080/10670564.2014.932148

The rise of the rogue executive: how good companies go bad and how to stop the destruction. (2006). Choice Reviews Online, 43(05), 43-2885-43-2885. http://dx.doi.org/10.5860/choice.43-2885

Cite this page

How Bad Is China from the Perspectives of U.S. Companies? Free Essay. (2017, Dec 05). Retrieved from https://speedypaper.com/essays/how-bad-is-china-from-the-perspectives-of-us-companies

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Why Your Best Friend Might Not Really Always Be Your Best Friend. Free Essay.

- Research in Education with SPSS, Statistics Essay Sample

- Essay Example on How to Reduce Stress for Students

- Essay Example on Teaching and Philosophy

- Free Essay: Cell Phones Keep Us Both Connected and Less Connected To Other People

- Free Essay: Referral Program Analysis in the Example of the Insurance Company

- Situational Awareness of Speeding. Free Essay

Popular categories