a) The Treasury Inflation Index Securities may be interpreted as real interest rates and therefore their decline in the 2008-2009 recession indicates that the inflation rates rose higher than anticipated. Essentially, lenders always calculate nominal interest rate with consideration of inflation, there is a probability of misjudging the economic climate thereby settling on an inflation rate that way lower than the actual rate. Accordingly, the real interest rates were very low.

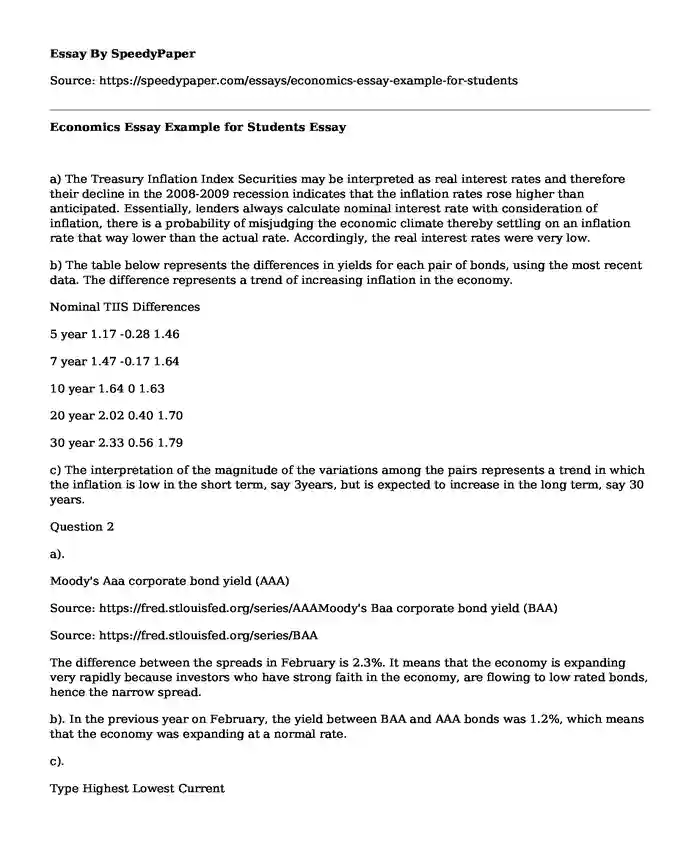

b) The table below represents the differences in yields for each pair of bonds, using the most recent data. The difference represents a trend of increasing inflation in the economy.

Nominal TIIS Differences

5 year 1.17 -0.28 1.46

7 year 1.47 -0.17 1.64

10 year 1.64 0 1.63

20 year 2.02 0.40 1.70

30 year 2.33 0.56 1.79

c) The interpretation of the magnitude of the variations among the pairs represents a trend in which the inflation is low in the short term, say 3years, but is expected to increase in the long term, say 30 years.

Question 2

a).

Moody's Aaa corporate bond yield (AAA)

Source: https://fred.stlouisfed.org/series/AAAMoody's Baa corporate bond yield (BAA)

Source: https://fred.stlouisfed.org/series/BAA

The difference between the spreads in February is 2.3%. It means that the economy is expanding very rapidly because investors who have strong faith in the economy, are flowing to low rated bonds, hence the narrow spread.

b). In the previous year on February, the yield between BAA and AAA bonds was 1.2%, which means that the economy was expanding at a normal rate.

c).

Type Highest Lowest Current

AAA May 2000: 7.99 August 2016: 3.32 Feb 2018: 3.82

BAA November 2008: 9.21 July 2016: 4.22 Feb 2018: 4.51

The gap between the spreads continues to decrease as compared to the current spread data. The implication is that investors can safely invest in either of the bonds since they have confidence in the economy.

Question 3

Eugen Fama and Robert Shiller

Eugen F. Fama and Robert J. Shiller were awarded the Nobel Memorial Prize in Economic Science in October 2013. The economist Robert Shiller had illustrated the rapid increase of house prices and considered the effect as bubble and gave a warning that the price would have declined by almost 40 percent (Nobelprize.org, 2017). This description by Robert was given in 2005 (Nobelprize.org, 2017). However, five years later, the home prices were well fulfilling and meeting his prediction but the economist Eugene Fama never believed that the market experienced the bubble. Mr. Fama authored the theory of asset prices that efficiently reflect all information. The two economists held leading ideas of opposing standpoint on the aspect of financial markets rationality. Their disputes had significant implication upon investment strategy, economic policies and financial regulation (Nobelprize.org, 2017).

The economist Fama had the seminal theory of rational, efficient markets which fostered the increase in funds index contributing to the demur of financial regulations (Nobelprize.org, 2017). The economist Shiller common critics cited the evidence on core areas of inefficient, irrational behaviors and sourced a metric of fame via prediction of stock price decline in 2000 and a housing crisis or crash that started in 2006. Conversely, the award was to be shared with another American economist Lars Peter who initiated the method of statistical analysis for evaluating theories on price movements that has been widely accepted and used by social scientists (Nobelprize.org, 2017).

These economists worked independently and were capable of cooperatively enlightening the process of financial markets where bond and stock prices are shown to move capriciously in the short-term but having a great prediction on long periods. These economists' findings indicated that markets were progressed by a mix of irrational behavior and rational calculus (Nobelprize.org, 2017).

Question 4

Research ideas by Akerlof, Spence, and Stiglitz

The theory of markets with asymmetric information has been significant and live in the economic research field. According to the economists' idea, borrowers tend to understand more than the lender on the repayment panorama and other conditions (Akerlof, Spence & Stiglitz, nd). Mainly, Akerlof has described the idea that information asymmetries may cause an increase in adverse selection within the markets. Spense, on the other hand, argues that, with imperfect information held by the lenders, borrowers that have weaker repayment potentiality tend to crowd all others from the market (Akerlof, Spence & Stiglitz, nd). This has been described under certain conditions whereby a well-versed agent has the capacity of improving the market outcome via hinting the private info to the poorly-versed agent. Hence, the firm management may find themselves incurring extra tax cost of dividends to hint high level of profit. Signaling within different markets has been found to be an important theory. Such tends to cover the expensive advertising such as signals of productivity, aggressive price reductions as a sign of market strength and recession for generation of monetary policy (Akerlof, Spence & Stiglitz, nd).

In addition, Stiglitz has indicated that the uninformed agents may at a time hold the info of another well-informed agent via screening. For instance, this is well enhanced via the provision of alternative choices from the agreement menu for a given transaction. Therefore, insurance firms are capable of dividing the customers into various risks classes via the provision of diverse policies, where low premiums are easily exchanged for the high deductions (Akerlof, Spence & Stiglitz, nd).

Together, Stiglitz, Akerlof, and Spense have been able to transform the way many economists think about the operation of markets. Altogether, these economists have created the significance of contemporary economics of information.

References

Akerlof, G.A., Spence, M., & Stiglitz, JE, (nd).The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 2001. Retrieved from: https://www.nobelprize.org/nobel_prizes/economic-sciences/laureates/2001/popular.html

Nobel prize.org., (2017). The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. Retrieved from: https://www.nobelprize.org/nobel_prizes/economic-sciences/

Cite this page

Economics Essay Example for Students. (2022, Apr 12). Retrieved from https://speedypaper.com/essays/economics-essay-example-for-students

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Example on Trip Advisor for Free

- Kant and Mill in the Free Philosophy Essay Sample

- Short Independent Research ProjectIntroduction

- Essay Example on Media and Aggression in Young People

- Essay Sample on Immigration in Texas

- Free Essay Example on Climate Change As a Major Problem

- Free Essay: Prevention and Management of Pressure Ulcers

Popular categories