| Type of paper: | Case study |

| Categories: | Education War Ethics Art Disorder |

| Pages: | 5 |

| Wordcount: | 1337 words |

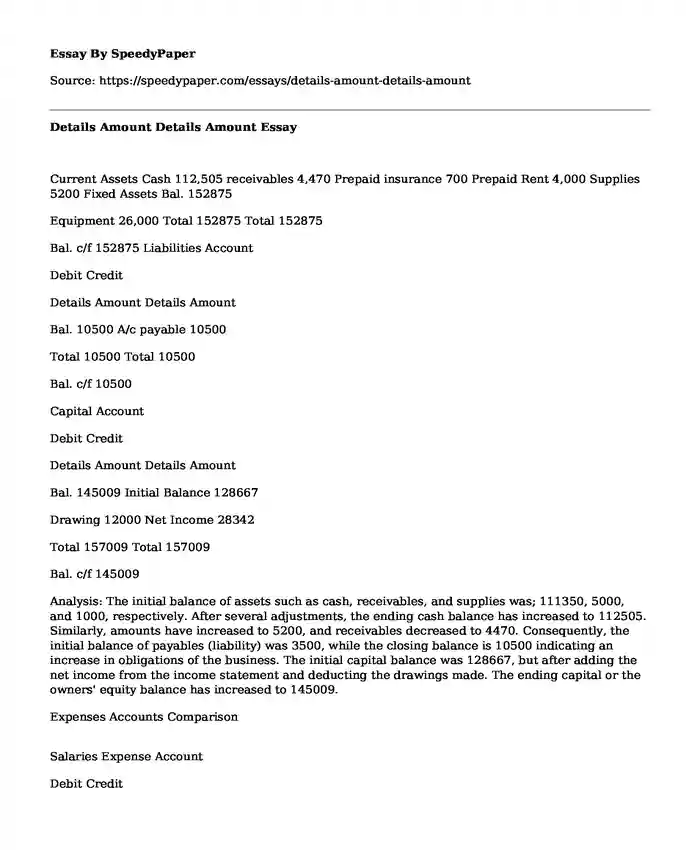

Current Assets Cash 112,505 receivables 4,470 Prepaid insurance 700 Prepaid Rent 4,000 Supplies 5200 Fixed Assets Bal. 152875

Equipment 26,000 Total 152875 Total 152875

Bal. c/f 152875 Liabilities Account

Debit Credit

Details Amount Details Amount

Bal. 10500 A/c payable 10500

Total 10500 Total 10500

Bal. c/f 10500

Capital Account

Debit Credit

Details Amount Details Amount

Bal. 145009 Initial Balance 128667

Drawing 12000 Net Income 28342

Total 157009 Total 157009

Bal. c/f 145009

Analysis: The initial balance of assets such as cash, receivables, and supplies was; 111350, 5000, and 1000, respectively. After several adjustments, the ending cash balance has increased to 112505. Similarly, amounts have increased to 5200, and receivables decreased to 4470. Consequently, the initial balance of payables (liability) was 3500, while the closing balance is 10500 indicating an increase in obligations of the business. The initial capital balance was 128667, but after adding the net income from the income statement and deducting the drawings made. The ending capital or the owners' equity balance has increased to 145009.

Expenses Accounts Comparison

Salaries Expense Account

Debit Credit

Details Amount Details Amount

Jan 31 32500 Bal. 32500

Total 32500 Total 32500

Bal. c/f 32500 Percentage= Salaries Expense Total Expenses

= 32500 66628

= 49%

Utility Expense Account

Debit Credit

Details Amount Details Amount

Jan 28 2675 Bal. 2675

Total 2675 Total 2675

Bal. c/f 2675 Percentage= Utilities Expense Total Expenses

= 2675 66628

= 4%

Insurance Expense Account

Debit Credit

Details Amount Details Amount

Jan 31 700 Bal. 700

Total 700 Total 700

Bal. c/f 700

Percentage= Insurance Expense Total Expenses

= 700 66628

= 1%

Maintenance Expense Account

Debit Credit

Details Amount Details Amount

Jan 21 7065 Bal. 11215

Jan 31 4150 Total 11215 Total 11215

Bal.c/f 11215 Percentage= Maintenance Expense Total Expenses

= 11215 66628

= 16.8%

Supplies Expense Account

Debit Credit

Details Amount Details Amount

Jan 31 7050 Bal. 7050

Total 7050 Total 7050

Bal. c/f 7050 Percentage= Supplies Expenses Total Expenses

= 7050 66628

= 10.5%

Rent Expense Account

Debit Credit

Details Amount Details Amount

Jan 31 4000 Bal. 4000

Total 4000 Total 4000

Bal. c/f 4000 Percentage= Rent Expenses Total Expenses

= 4000 66928

= 6%

Advertising Expense Account

Debit Credit

Details Amount Details Amount

Jan 21 3600 Bal. 7280

Jan 22 3680 Total 7280 Total 7280

Bal. c/f 7280 Percentage= Advertising Expenses Total Expenses

= 7280 66628

= 10.88%

Telephone Expense Account

Debit Credit

Details Amount Details Amount

Jan 22 1025 Bal. 1025

Total 1025 Total 1025

Bal. c/f 1025 Percentage= Telephone Expenses Total Expenses

= 1025 66628

= 1.5%

Depreciation Expense Account

Debit Credit

Details Amount Details Amount

Jan 31 183 Bal. 183

Total 183 Total 183

Bal. c/f 183 Percentage= Depreciation Expenses Total Expenses

= 183 66928

= 0.3%

What is Affecting Net Income?

Mostly expenses hurt net income, for example, in this scenario. Salaries are occupying 49% of the total expense, which almost half of the company expenses and too high. Therefore, wages are contributing to a decline in the company's net income. The very reason many companies exist is to generate profits. The decrease in net income contributes to the reduced dividend to the shareholders and net profit of the company. The more you spend on materials, payroll, and overhead, the less you have left at the end of the day. The company should evaluate this issue by terminating the employment contract of underperforming and highly paid employees.

Book Value

The book value of an asset is the amount at which the assets are valued in the company balance sheet. An asset such as the equipment in the scenario has wear and tear, therefore, contributing to depreciation. It influences an increase in accumulated depreciation while the book value decreases (Cahyaningrum & Antikasari, 2017). Depreciating the equipment helps to keep fair market values assigned and allows for spreading out the expense over time.

Equipment Book Value = Equipment initial price less Accumulated Depreciation

Book value = 26000 - 366

=25,634

. Usually, the machine is an investment a company has made to assist it in sustaining a successful and profitable future. The company equipment depreciation is 183 each time, meaning it's wearing out at a slow rate, therefore, saving the company from other equipment purchased soon.

Return on Investments

ROI = Earnings before Interest and Tax Capital Employed

Capital Employed = Non-current Assets + Working Capital (Current assets - Current Liabilities)

Capital Employed =26000 + 116375

= 142375

ROI = 28342 142375

= 0.199

= 20% or 20: 1

Many executives consider return on investment to be the most important profitability ratio (Pech, Noguera & White, 2015). Return on investment determines the return on the owner's investment. The return on investment value can aid management know whether their input work has been worth it. The above figure 20 % or 20: 1 shows the company productivity is high resulting to good profits.

Business Ratios

Current Ratio

Current Ratio = Current Assets Current Liabilities

= 126875 10500

= 12: 1

Current ratio weighs the company capability to settle short-term debts using current assets (cash, receivables, prepaid expenses, and stock) (Mitrovic, Knezevic & Velickovic, 2015). In this scenario, for every 1 in current liabilities, the company has 12 in current assets. A current ratio that is greater than 1 to 1 is viewed positively; the greater the proportion, the better the company's financial position. Therefore, this company is in a sound financial situation, and the current ratio of 12 to 1 indicates that they can pay their short-term obligations.

Social Conscience Focus: lack of diversity in the executive level

The difference is manifested through cultural background, ethnicity, gender, and a different set of skills acquired, thus providing multiple perspectives and experiences. A company with two or more women and other under-represented groups at the managerial level has a more diverse labor force. According to McKinsey, companies report an average return on investment of 22% compared to an average return on investment of 15% quarterly when women are included in the executive committee. Correspondingly, information released by the World Economic Forum shows that facilitating women to establish their own business could instantly increase economic input. Therefore, when a company lacks diversity at the executive level, it may face some difficulties.

Disadvantages of lacking Diversity

The threat of equivalence: the company managerial staff thinking alike (group thinking), driving out better decision making, better and numerous results. It can mark itself in the strong desire for group unanimity even in the face of resistance, critical analysis, and experience obtained. Equivalence is convoyed by the risk of exclusion, as opposed to the value of inclusion. The company can pay attention to some staff and ignore other management staff. The ignored are excluded from declaring their thoughts, details, and critical thinking. The risk of exclusion is mainly enabled similar idea, with its supplementary jeopardies.

The threat of overconfidence: Overconfidence is mostly seen in dominant executive members whose extraordinary self-esteem can truly build problems. Mostly, men have a habit of overrating their performance, speaking without preparedness, and talking over other staff. A study conducted in 2011 discovered that men have a regular tendency to exaggerate their past performance on math tasks by 30%. Exaggerated self-assurance can give rise to ill-prepared approaches and risky decisions. Another study indicates that men traded stock nearly 50 percent compared to women, thus increasing cost and lowering their rate of return. Women are most likely to take a few risks and do more research through questions. The organization should balance out executive members with overconfident opinions with those that question decisions for the company to grow. (Gamayuni, 2015)

Reputational threat and management image: A company lacking profound diverse programs and policies is at a chance of getting class-action suits and negative image that the company is aware of misconduct but fails to act. Thus it results from dropping in prices of stocks, a boycott of products and services, and fury of activist and institutional investors. Roughly 55% of specialized women question by #MeToo at Work are least likely to make a job application, and 49% are least likely to purchase services or stock from a company with damaging allegations. Research by Catalyst has discovered that there are minimal cases of corruption, bribery, shareholders clashes, and fraud when mixed-gender are on the executive level. Therefore, companies need to place women on the board of directors and other top positions in the company.

Step 2

Summary of Findings

The company cash and supplies have increased in comparison with the opening balances, while the account receivable balance has slightly reduced. The company liabilities have risen, and also, the owners' equity has increased. The salaries expense of the company is too high compared to the other cost, thus impacting net income to reduce. The company equipment has a steady depreciation rate of 183. The machine is an investment; it contributing to company profitability and aids operation success. The return on investment ratio 20: 1 indication that the company's management is making decision making is at par, and employees are performing, thus good profits. The current or liquidity ratio of the company is 12: 1, indicating the company can pay its short term debts by liquefying the existing assets, thus, sound financial position. The net income of the company is 28122, and the owners' equity is 144789.

Companies lacking diversity at the executive level are most like to face a lot of chall...

Cite this page

Details Amount Details Amount. (2023, Mar 04). Retrieved from https://speedypaper.com/essays/details-amount-details-amount

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay on Types of Intercultural Conflicts

- Free Essay: Assumptions about the Child, the Family and Early Childhood Education

- Essay Example on Health Information Technology Systems Life Cycle

- Essay Sample on Organizational Behavior and Work

- Essay Example: Divisiveness in Our Country Today

- Essay Sample with an Analysis of Crime Investigation Approaches

- Financial Accounting Topics, Free Essay Sample

Popular categories