| Type of paper: | Essay |

| Categories: | Data analysis Budgeting Strategic management Financial analysis |

| Pages: | 6 |

| Wordcount: | 1567 words |

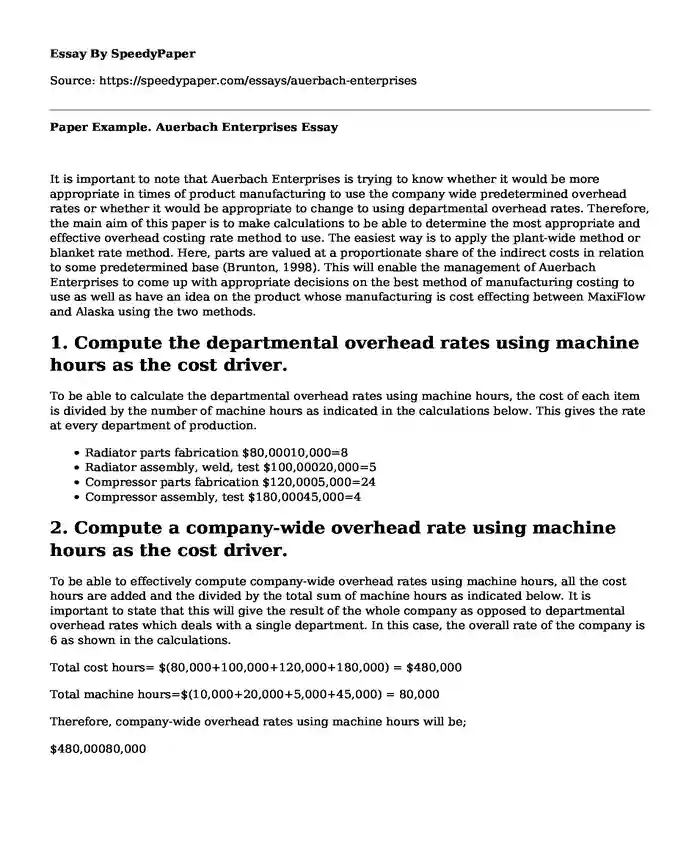

It is important to note that Auerbach Enterprises is trying to know whether it would be more appropriate in times of product manufacturing to use the company wide predetermined overhead rates or whether it would be appropriate to change to using departmental overhead rates. Therefore, the main aim of this paper is to make calculations to be able to determine the most appropriate and effective overhead costing rate method to use. The easiest way is to apply the plant-wide method or blanket rate method. Here, parts are valued at a proportionate share of the indirect costs in relation to some predetermined base (Brunton, 1998). This will enable the management of Auerbach Enterprises to come up with appropriate decisions on the best method of manufacturing costing to use as well as have an idea on the product whose manufacturing is cost effecting between MaxiFlow and Alaska using the two methods.

1. Compute the departmental overhead rates using machine hours as the cost driver.

To be able to calculate the departmental overhead rates using machine hours, the cost of each item is divided by the number of machine hours as indicated in the calculations below. This gives the rate at every department of production.

- Radiator parts fabrication $80,00010,000=8

- Radiator assembly, weld, test $100,00020,000=5

- Compressor parts fabrication $120,0005,000=24

- Compressor assembly, test $180,00045,000=4

2. Compute a company-wide overhead rate using machine hours as the cost driver.

To be able to effectively compute company-wide overhead rates using machine hours, all the cost hours are added and the divided by the total sum of machine hours as indicated below. It is important to state that this will give the result of the whole company as opposed to departmental overhead rates which deals with a single department. In this case, the overall rate of the company is 6 as shown in the calculations.

Total cost hours= $(80,000+100,000+120,000+180,000) = $480,000

Total machine hours=$(10,000+20,000+5,000+45,000) = 80,000

Therefore, company-wide overhead rates using machine hours will be;

$480,00080,000

3. Compute the overhead costs per batch of Maxi Flow and Alaska assuming:

The company-wide rate.

While using company-wide method to calculate the overhead costs per batch of both products, the company-wide rate is used. In this case, the total number of hours spent on a given batch is multiplied by the company-wide rate. As can be observed for MaxiFlow, the total cost of the batches is $696. The same procedure is followed while calculating the overhead cost per batch of Alaska.

Overhead cost per batch of Maxi Flow

- Fabrication of radiator parts 28hours6=168

- Radiator assembly, weld, and test 30hours6=180

- Fabrication of compressor parts 32hours6=192

- Compressor assembly and test 26hours6=156

- Total = 696

Overhead cost per batch of Alaska

- Fabrication of radiator parts 16hours6=96

- Radiator assembly, weld, and test 74hours6=444

- Fabrication of compressor parts 8 hours6=48

- Compressor assembly and test 66hour6=396

- Total = 984

The departmental rates.

Overhead cost per batch using departmental rates

However, while calculating the cost per batch using departmental rates, the number of hours spent in every department is multiplied by the rates at each department. This is indicated in the calculations for MaxiFlow and Alaska as shown below.

Maxi Flow

- Fabrication of radiator parts 28hours8=224

- Radiator assembly, weld and test 30hours5=150

- Fabrication of compressor parts 32hours24=768

- Compressor assembly and test 26hours4=104

- Total = 1246

Alaska

- Fabrication of radiator parts 16hours8=128

- Radiator assembly, weld and test 74hours5=370

- Fabrication of compressor parts 8hours24=192

- Compressor assembly and test 66hours4=264

- Total = 954

4. Compute the total costs per unit of MaxiFlow and Alaska assuming:

The company-wide rate.

It is important to note that while using company-wide rate to calculate cost per unit of each product, the costs at each department are added to come up with the overall cost for the company. In the calculations below, the total costs per unit are indicated and the overall costs of the units whereby for MaxiFlow it is $906 per unit while Alaska is $1189 per unit.

The total cost of Maxi Flow using company-wide rate

- Direct Material $135 per unit

- Direct Labor $75 per unit

- Radiator parts fabrication $168 per unit

- Radiator assembly, weld and test $180 per unit

- Fabrication of compressor parts $192 per unit

- Compressor assembly and test $156 per unit

- Total $906/unit

The total cost of Alaska using company-wide rate

- Direct Material $110 per unit

- Direct Labor $95 per unit

- Radiator parts fabrication $96 per unit

- Radiator assembly, weld and test $444 per unit

- Fabrication of compressor parts $48 per unit

- Compressor assembly and test $396 per unit

- Total = 1,189/unit

The departmental rates.

Here, the total cost per unit of each item is indicated as calculated using the departmental rates. For example, from my calculation, the cost per unit of fabrication of radiator parts for the MaxiFlow product is $224 while that of Alaska is $128. It should be noted that these costs will help the management to distinguish between these two products is cost effective there helping them in the decision making process. The total costs are also indicated as shown in the calculations below.

Total cost per of Maxi Flow using departmental rate

- Description $

- Direct material 135

- Direct labor 75

- Fabrication of radiator parts 224

- Radiator assembly, weld and test 150

- Fabrication of compressor part 768

- Compressor assembly and test 104

- Total = 1,456/unit

Total cost per unit of Alaska using departmental rate

- Description $

- Direct material 110

- Direct labor 95

- Fabrication of radiator parts 128

- Radiator assembly, weld and test 370

- Fabrication of compressor part 192

- Compressor assembly and test 264

- Total = 1,159/unit

Conclusion and Recommendation

As can be observed from the workings above, the departmental rates of MaxiFlow cost $1,456 per unit while the company-wide rate cost is $906 per unit which translates to a difference of $550 for every unit (Cooper & Kaplan, 1988). Considering Alaska, using departmental rates costs $1,159 per unit while that of a company-wide rate is $1,189 per unit for a difference of $30 for every unit (Datars et al., 1993).

Therefore, it can be concluded that MaxiFlow is affected more by using than Alaska. As can be noticed, the biggest area of change is the fabrication of compressor parts which moves from $192 while using a company-wide rate to $768 while using departmental rates, a difference of $576 per unit. It should be understood that when using departmental rates, the averaging effects of the process of costing are broken down in a clearer and therefore, more accurate cost assignment occurs (Datars et al., 1993).

About the calculations on the departmental rates, it is observed from the total cost per unit that the costs involved are high as compared to using the company-wide method. This is because when using departmental rates, the total cost per unit of MaxiFlow is $1456 while that of Alaska is $1159. However, while using company-wide in the costing of the manufacture of the two products, it is realized that MaxiFlow is $906 per unit while Alaska is $1189. In light of the above, it is evident that company-wide is the most appropriate method to use and therefore, as had been suggested earlier, Auerbach Enterprises should stick to using this method. However, in another recommendation to the management, it would be important to mention that if the management decides to produce only one product, then the most appropriate one would be Alaska. This is because as opposed to only $30 difference in using departmental rates to cost Alaska products, MaxiFlow indicated a huge difference in the departmental rates, which was $550. This is enough to inform the management that Alaska would be the most appropriate product to manufacture.

In the current competitive business environment, it is important for businesses to choose the most appropriate and effective overhead rate, especially because it will help to guide the management of the organization in product pricing, budgeting as well as job costing. Truly, the ability of an organization to remain focused and competitive depends on how well it implements solutions that would help in the cost-cutting within the business (Cooper & Kaplan, 1988). As had been said, MaxiFlow is more affected based on the unit cost as indicated in the calculations than Alaska by using the departmental rates. As can be noticed, the company-wide rate is better suited for a company that only produces one product. However, since Auerbach has several departments as well as manufacturing sections, a more clear and accurate overhead rate can be obtained by the use of the departmental overhead rate method as opposed to company-wide rate method.

Also, with the use of machine hours in place of direct labor as the main cost driver in assigning overhead cost suggest that Auerbach enterprises perform the majority of its production by machine and not through physical labor (Datars et al., 1993). It is true that in the modern highly automated systems, costs related to labor only constitute a negligible portion of manufacturing costs and therefore overhead cost correlates more with factors like material quantities and machine hours. However, regardless of whether a company uses departmental overhead rates or company-wide overhead rates, the effectiveness of these systems, majorly depends on the type of business organization that uses them.

In conclusion, the planning information that was compiled by Auerbach Enterprises was to help the management determine if it would be advantageous to change its production system from the current company-wide predetermined overhead to departmental overhead rates (Brunton, 1998). This step was very important for the company as it helps to choose the most effective and appropriate rate to use. This will further help the company management in the job costing, budgeting as well as the product pricing process. Simply put, it is the bottom line of an organization choosing the appropriate method that is deemed to provide it with accurate results for business success.

References

Brunton, N. M. (1988). Evaluation of overhead allocations. Strategic Finance, 70(1), 22.

https://www.sciencedirect.com/science/article/pii/S109830151060795"

Cite this page

Paper Example. Auerbach Enterprises. (2023, Jan 19). Retrieved from https://speedypaper.com/essays/auerbach-enterprises

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Promotion At Work Essay Example

- Essay Example: Reflective Analysis of the Student

- Essay Example on Mad Men and the Paradox of the Past

- Interpretive Essay Example on the Song of the Scaffold

- Free Essay Example: Tests of Truth

- Free Essay - Elvis Presley's Letter to Richard Nixon

- Paper Example. Work-Life Committee

Popular categories