Economic value added refers to the value of net operating profit after tax less the capital charge of the firm. It shows the marginal difference between the cost of capital and the required rate of return.

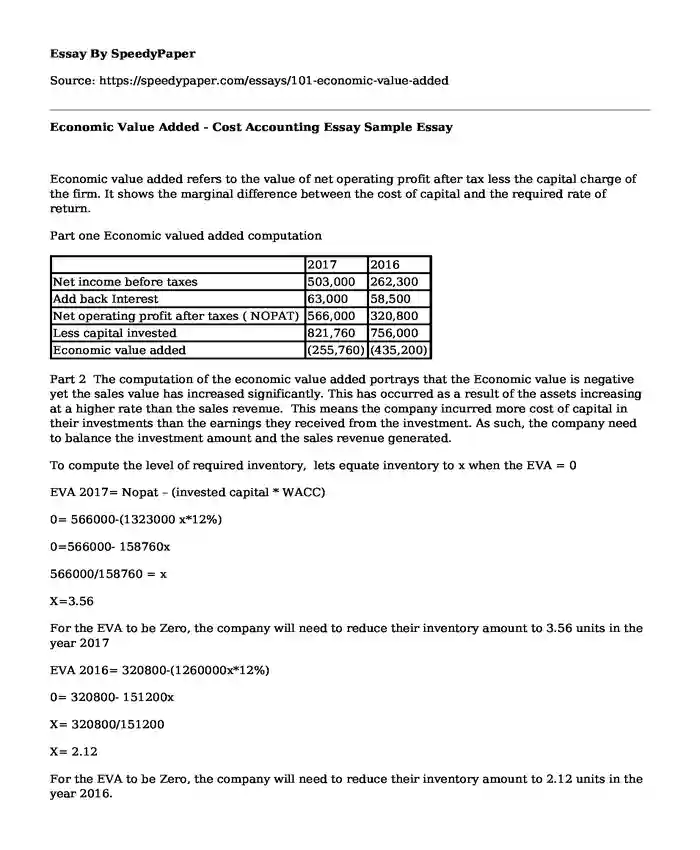

Part one Economic valued added computation

2017 |

2016 |

|

Net income before taxes |

503,000 |

262,300 |

Add back Interest |

63,000 |

58,500 |

Net operating profit after taxes ( NOPAT) |

566,000 |

320,800 |

Less capital invested |

821,760 |

756,000 |

Economic value added |

(255,760) |

(435,200) |

Part 2 The computation of the economic value added portrays that the Economic value is negative yet the sales value has increased significantly. This has occurred as a result of the assets increasing at a higher rate than the sales revenue. This means the company incurred more cost of capital in their investments than the earnings they received from the investment. As such, the company need to balance the investment amount and the sales revenue generated.

To compute the level of required inventory, lets equate inventory to x when the EVA = 0

EVA 2017= Nopat – (invested capital * WACC)

0= 566000-(1323000 x*12%)

0=566000- 158760x

566000/158760 = x

X=3.56

For the EVA to be Zero, the company will need to reduce their inventory amount to 3.56 units in the year 2017

EVA 2016= 320800-(1260000x*12%)

0= 320800- 151200x

X= 320800/151200

X= 2.12

For the EVA to be Zero, the company will need to reduce their inventory amount to 2.12 units in the year 2016.

Part 3

EVA 2017= Nopat – (invested capital * WACC) (Horngren, 2009).

0= 566000-(1323000-750000) x*12%)

0=566000-1248000x*12%

0=566000- 149760x

566000/149760= x

X=3.78 units

Thus the company need to hold 3.78 units of inventory for the EVA to be zero in 2017.

EVA 2016= 320800-(1260000-75000) x*12%)

0= 320800- 142200x

X= 320800/142200

X= 2.26

Thus the company need to hold 2.26 units of inventory for the EVA to be zero in 2016

References

Horngren, C. T. (2009). Cost accounting: A managerial emphasis, 13/e. Pearson Education India.

Cite this page

Economic Value Added - Cost Accounting Essay Sample. (2018, Apr 20). Retrieved from https://speedypaper.com/essays/101-economic-value-added

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay on the Role of Education in Creating Social Change

- Moral philosophy essay

- Art Essay Example: The Card Player by Paul Cezanne (Painting)

- Free Essay Sample: Intelligence and Counterintelligence

- The Road to Globalization, Essay Sample for Your Attention

- Essay sample on Aviation History

- Essay Sample on Symptom: "They Make Me Mad."

Popular categories