| Type of paper: | Problem solving |

| Categories: | Starbucks Financial analysis Financial management |

| Pages: | 4 |

| Wordcount: | 835 words |

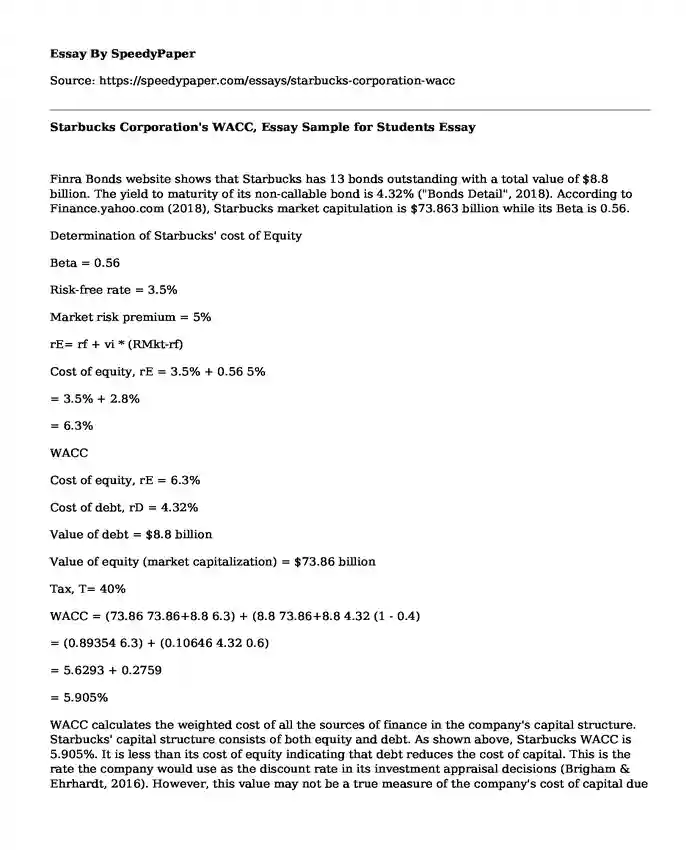

Finra Bonds website shows that Starbucks has 13 bonds outstanding with a total value of $8.8 billion. The yield to maturity of its non-callable bond is 4.32% ("Bonds Detail", 2018). According to Finance.yahoo.com (2018), Starbucks market capitulation is $73.863 billion while its Beta is 0.56.

Determination of Starbucks' cost of Equity

Beta = 0.56

Risk-free rate = 3.5%

Market risk premium = 5%

rE= rf + vi * (RMkt-rf)

Cost of equity, rE = 3.5% + 0.56 5%

= 3.5% + 2.8%

= 6.3%

WACC

Cost of equity, rE = 6.3%

Cost of debt, rD = 4.32%

Value of debt = $8.8 billion

Value of equity (market capitalization) = $73.86 billion

Tax, T= 40%

WACC = (73.86 73.86+8.8 6.3) + (8.8 73.86+8.8 4.32 (1 - 0.4)

= (0.89354 6.3) + (0.10646 4.32 0.6)

= 5.6293 + 0.2759

= 5.905%

WACC calculates the weighted cost of all the sources of finance in the company's capital structure. Starbucks' capital structure consists of both equity and debt. As shown above, Starbucks WACC is 5.905%. It is less than its cost of equity indicating that debt reduces the cost of capital. This is the rate the company would use as the discount rate in its investment appraisal decisions (Brigham & Ehrhardt, 2016). However, this value may not be a true measure of the company's cost of capital due to the inherent limitations associated with the assumptions used. Its determination relies on the estimation of the cost of equity using the CAPM. The CAPM assumes the existence of a risk-free rate, in this case, 3.5% (the yield on 10-year US Treasury security). The yield on Treasury securities changes daily hence the risk-free rate used may not be relevant for other periods. It further assumes that investors can borrow and lend at the risk-free rate (Brigham & Ehrhardt, 2016). This is one of the biggest problems of the CAPM since, in the real-life situation, it is not possible to borrow or lend at the risk-free rate. The risk associated with individual investors is different and higher than associated with the US government. Thus, the inability to borrow and lend at the risk-free rate makes the cost of equity determined using the CAPM unrealistic.

Besides, the determination of the market risk premium is arbitrary. The market risk premium is set at 5%, which may not be the case. The market risk premium and beta used in the calculation of WACC are historically-based and not forward-looking. The CAPM is also based on the premise that the capital markets are perfect (Brigham & Ehrhardt, 2016). Perfect capital markets refer to markets where securities are accurately priced (Brigham & Ehrhardt, 2016). This happens when investors have homogeneous expectations about the market and all act rationally by requiring a high return for high systematic risk (Brigham & Ehrhardt, 2016). However, not all investors in the market act rationally, and some are risk-indifferent and risk-seekers. Other conditions for perfect capital markets include no taxes, perfect and freely available information to investors. These assumptions are unrealistic since there are taxes. Furthermore, although the US and other major capital markets are efficient, perfect information is still not available to all investors. This explains why some investors earn higher returns than others.

The CAPM also assumes a single-period investment horizon (Brigham & Ehrhardt, 2016). The variables used in CAPM are not constant hence cannot be used over more than one period. For instance, the yield on US Treasury securities changes daily hence the cost of equity of a company is not constant. This makes the cost of equity and WACC estimated unreliable. The Beta of stocks also varies from one period to another. This is a significant limitation since most investors invest for more than one period. The model also assumes that investors have diversified all unsystematic risk and base their required returns on systematic risk. However, not all investors have diversified portfolios.

The WACC approach assumes a constant ratio of debt and equity in the capital. However, this is not usually the case in a real-life situation. The market value of equity (E) is considered to be the market capitalization of the company. This is influenced by the stock's market price and the volume of shares traded. Stock market prices vary hence it is not possible to have a constant ratio of debt and equity.

The above limitations make the WACC calculated unreliable for use as Starbucks cost of capital. It is based on several assumptions, some of which are unrealistic. The limitations of the CAPM used to calculate the cost of equity makes the WACC above inaccurate. The use of this value in appraising investment options can be misleading. The values used in the WACC formula are historical and change over time. Projects' cash flows are future cash flows and should be evaluated using forward-looking measures. The WACC may be lower or more than the actual cost of capital. If WACC is overstated, Starbucks may incorrectly reject projects that are otherwise profitable. To mitigate the limitations of the WACC calculated, the company should regularly review the components to monitor significant changes and take make necessary corrections.

References

Bonds Detail. (2018). Retrieved from http://finra-markets.morningstar.com/BondCenter/BondDetail.jsp?ticker=C632123&symbol=SBUX4254475

Brigham, E., & Ehrhardt, M. (2016). Financial Management Theory and Practice. New York: Cengage Learning.

Finance.yahoo.com. (2018). Starbucks Corporation (SBUX). Retrieved from https://finance.yahoo.com/quote/SBUX/

Cite this page

Starbucks Corporation's WACC, Essay Sample for Students. (2022, Jul 14). Retrieved from https://speedypaper.com/essays/starbucks-corporation-wacc

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay: Self-improvement According to Jonathan Edward

- Essay Sample on Kpone City Branding

- Free Essay with Business Model Generation

- Essay Example on Internships and Why Are They Significant

- Close Betrayal - Free Essay Describing Personal Experience

- Free Paper Sample on Intrinsic and Extrinsic Values

- Free Essay Sample. Brazilian Mining Case

Popular categories