| Type of paper: | Problem solving |

| Categories: | Management Marketing Banking |

| Pages: | 3 |

| Wordcount: | 784 words |

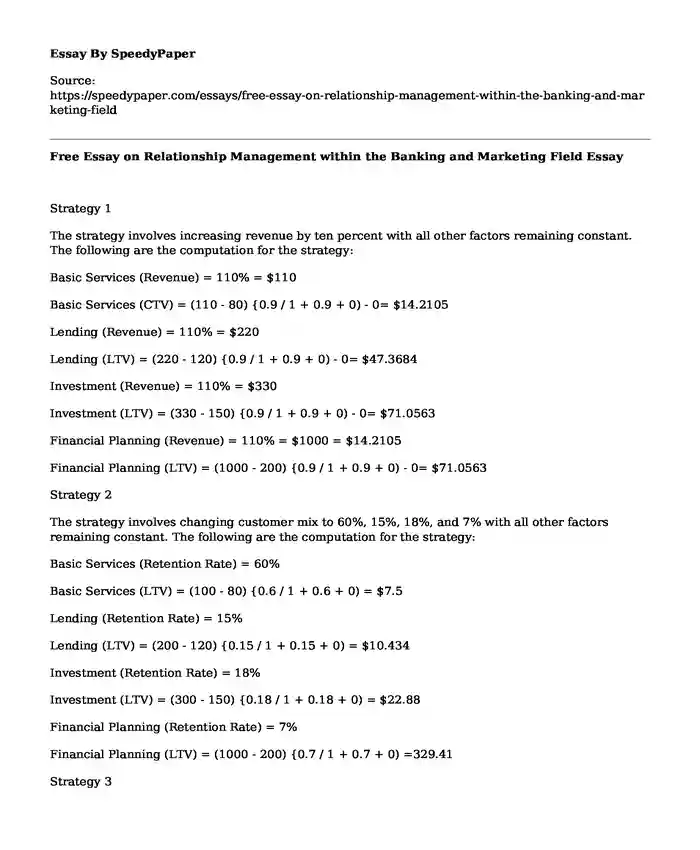

Strategy 1

The strategy involves increasing revenue by ten percent with all other factors remaining constant. The following are the computation for the strategy:

Basic Services (Revenue) = 110% = $110

Basic Services (CTV) = (110 - 80) {0.9 / 1 + 0.9 + 0) - 0= $14.2105

Lending (Revenue) = 110% = $220

Lending (LTV) = (220 - 120) {0.9 / 1 + 0.9 + 0) - 0= $47.3684

Investment (Revenue) = 110% = $330

Investment (LTV) = (330 - 150) {0.9 / 1 + 0.9 + 0) - 0= $71.0563

Financial Planning (Revenue) = 110% = $1000 = $14.2105

Financial Planning (LTV) = (1000 - 200) {0.9 / 1 + 0.9 + 0) - 0= $71.0563

Strategy 2

The strategy involves changing customer mix to 60%, 15%, 18%, and 7% with all other factors remaining constant. The following are the computation for the strategy:

Basic Services (Retention Rate) = 60%

Basic Services (LTV) = (100 - 80) {0.6 / 1 + 0.6 + 0) = $7.5

Lending (Retention Rate) = 15%

Lending (LTV) = (200 - 120) {0.15 / 1 + 0.15 + 0) = $10.434

Investment (Retention Rate) = 18%

Investment (LTV) = (300 - 150) {0.18 / 1 + 0.18 + 0) = $22.88

Financial Planning (Retention Rate) = 7%

Financial Planning (LTV) = (1000 - 200) {0.7 / 1 + 0.7 + 0) =329.41

Strategy 3

The strategy involves increasing retention rate of financial planning to 95%. The following are the computation for the strategy:

Basic Services (Retention Rate) = 90%

Basic Services (LTV) = (100 - 80) {0.9 / 1 + 0.9 + 0) = $9.4736

Lending (Retention Rate) = 90%

Lending (LTV) = (200 - 120) {0.9 / 1 + 0.9 + 0) = $37.8947

Investment (Retention Rate) = 90%

Investment (LTV) = (300 - 150) {0.9 / 1 + 0.9 + 0) = $71.0563

Financial Planning (Retention Rate) = 95%

Financial Planning (LTV) = (1000 - 200) {0.9 5/ 1 + 0.95 + 0) = $389.74

The idea of relationship management within the banking and marketing field has attracted considerable interest over the years. In the new mantra, customer relationship management pursues a long-term relationship with cost-effective and profitable clients. The definitive objective of any corporate activity is profitability. Without any unmistakable differentiation among the customers of the organization or special proposition of value, banking organizations regularly misuse significant company resources in their effort to serve every one of the clients that might possibly bring about a profitable income. All customers of the bank who are making exchanges with respect to financial instruments services or seeking service for the maintenance of financial accounts are assigned to retail customers. They are provided with a wide net of protective cover. Professional customers are provided with narrower protection than retail customers.

Although financial planning is paying highly, its lifetime customer value is not highly attractive. The CLV got Investment and Basic Services are the most profitable for the business as indicated above. The bank can get rid of Lending and Financial Planning because their profitability index shows that they are not as beneficial as other entities. The capacity to distinguish productive clients and fabricate long-terms with them is an important factor in the present exceedingly aggressive business environment. For the achievement of the above objective, the organization will have to embrace the idea of Customer Relationship Management in its business model to integrate its sales and marketing over various customer points of contact units. Under the CRM concept, clients are not alike and, in this way, it is preposterous for the organization common incentives offers across the board. Rather, organizations can choose just those clients who meet certain productivity criteria in view of their individual needs or buying behavior. Accurate of the profitability of a customer is a pivotal component for the success of the model. The main considerations for the prediction of customer profitability are lifetime and lifetime value. The rate of retention over a lifetime is critical in the prediction of the profitability value of the customer.

CLV Calculation Information Customer Information Annual Sales ($) Annual Growth Rate-Sales (%) Gross Margin (% sales) Operating Costs (% sales) Customer Retention (%) Lifetime (years) Acquisition Information Probability of Acquisition (%) Acquisition Investment ($) Sales Wages ($/hour) Sales Hours Discount Rate (%) Customer Lifetime Value

A B Class Average Sales Repeated Sales Average Good Sold Total Sales Per Cycle Profit Margin CLV

Basic Services 100 4 80 0.6 0.2 =$D6*$E6*$F6*$G6*$H6

Lending 200 0.75 120 0.15 0.667 =$D7*$E7*$F7*$G7*$H7

Investment 300 2 150 0.18 0.5 =$D8*$E8*$F8*$G8*$H8

Financial Planning 1000 0.25 200 0.07 0.8 =$D9*$E9*$F9*$G9*$H9

Class Average Sales Repeated Sales Average Good Sold Total Sales Per Cycle Profit Margin CLV

Basic Services $100 4 $80 60% 20% 3840

Lending $200 0.75 $120 15% 66.70% 1800.9

Investment $300 2 $150 18% 50% 8100

Financial Planning $1,000 0.25 $200 7% 80% 2800

The CLV got Investment and Basic Services are the most profitable for the business as indicated above. The bank can get rid of Lending and Financial Planning because their profitability index shows that they are not as beneficial as other entities. The capacity to distinguish productive clients and fabricate long-terms with them is an important factor in the present exceedingly aggressive business environment. For the achievement of the above objective, the organization will have to embrace the idea of Customer Relationship Management in its business model to integrate its sales and marketing over various customer points of contact units. Under the CRM concept, clients are not alike and, in this way, it is preposterous for the organization common incentives offers across the board. Rather, organizations can choose just those clients who meet certain productivity criteria in view of their individual needs or buying behavior. Accurate of the profitability of a customer is a pivotal component for the success of the model. The main considerations for the prediction of customer profitability are lifetime and lifetime value. The rate of retention over a lifetime is critical in the prediction of the profitability value of the customer.

Cite this page

Free Essay on Relationship Management within the Banking and Marketing Field. (2022, Mar 23). Retrieved from https://speedypaper.com/essays/free-essay-on-relationship-management-within-the-banking-and-marketing-field

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Sample about Fantasy Play in Pre-school Children

- Free Essay: Corps Commanders of the Bulge: The Victory of the USA

- Free Essay: Education Issues for Children with Learning Disabilities

- Behavioural Change Essay Sample

- Health Issue Essay Example: Unsafe Dietary Supplements

- Paper Example on the Humanitarian Organizations and Protection Projects for Donors

- Essay Sample on Importance of Breast in Baby's Development

Popular categories