| Type of paper: | Course work |

| Categories: | Finance Budgeting Money |

| Pages: | 5 |

| Wordcount: | 1112 words |

Automated Teller Machines are used for various purposes:

They are used by customers to print bank statements. Instead of customers waiting for long queues at the banking hall, they use their debit cards to get bank mini-statements from the ATM machines

ATM machines are also used by consumers to withdraw cash from their respective bank accounts using say their debit cards; they provide convenience to the consumers.

The ATM machines are also used by consumers to transfer money from one account to another. The machine has the instructions required to make such transfers, hence there is no need to visit the bank to perform such a transaction.

Mortgage loan

A mortgage is a form of agreement that enables a customer (borrower) to use his/her property as security to secure bank loans. Therefore, mortgage loans are applied by bank customers to buy a house, the customer signs an agreement that states that the lender has the legal authority to take action against a customer if they do not honour their loan repayments.

Savings account

Bank customers hold a savings account that they use to deposit money that customers do not intend to spend on regular expenses. Savings account earns the customers interest and typically limits the number of monthly withdrawals.

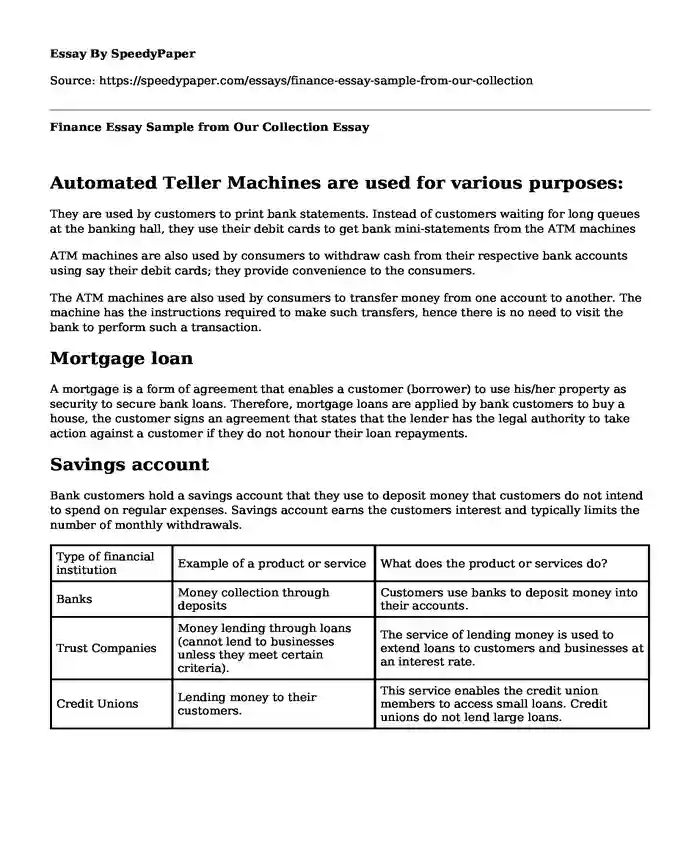

| Type of financial institution | Example of a product or service | What does the product or services do? |

| Banks | Money collection through deposits | Customers use banks to deposit money into their accounts. |

| Trust Companies | Money lending through loans (cannot lend to businesses unless they meet certain criteria). | The service of lending money is used to extend loans to customers and businesses at an interest rate. |

| Credit Unions | Lending money to their customers. | This service enables the credit union members to access small loans. Credit unions do not lend large loans. |

| Financial services | People use them to | Businesses use them to |

| Bank cards | Use debit cards to pay for their day-to-day expenses. Use credit cards to shop for things in shops or online on credit. | Use debit cards to make business purchases. Use credit cards to access credit funds to make purchases or withdraw cash |

| Traveler's cheque | To purchase goods and services especially while traveling abroad. | As a form of payment in areas with fewer ATM machines. |

| Direct deposits | Access their money from virtually everywhere. | Pay employees. |

| Loans | Buy homes. | To expand business operations. |

| Online banking | To open bank accounts and pay bills. | To keep track of incomes and expenses. |

Lesson 17

| Type of Investment | Yield | Growth | Risk | Liquidity |

| Guaranteed investment certificate | Low yields | Dependent on bank interest rates | Low risk | Low liquidity |

| bonds | High | slow growth | low risk | Low liquidity |

| Stock | High | Fast growth | high risk | High |

| Mutual funds | High if investments go up and vice versa | Fast if investments go up and vice versa | Depends on the area of investment | High |

| Real estate | High | Fast | High | low |

Ethical fund - This is a mutual fund whereby investment decisions are made by asset managers following some code of ethics. For example, a person could have a moral objection to smoking and may, therefore, purchase shares in a mutual fund that discourages investing in tobacco companies.

Lesson 18

For Leo Covallo's case, his total interest would be $2455, and the total amount repayable is $12,455. Therefore, he would be required to pay $207.6 each month. Since his monthly income is $1000, he has the capacity to pay the monthly amount. However, his assets cannot fully recover the loan; hence his capital rating is low. Also, Mr Covallo is a high school graduate having recently moved to a new place of work, therefore it is not certain he would reside there for the five years-his character rating is low too. There, I choose not to offer Mr Covallo the car loan.

Payoff period: 62 months

Total interest: $1077

Payoff period: 15 months

Total interest: $248

Total interest: $2,498.11

Total interest: $964.34

Total interest: $289,595.47

Total interest: $179,858.64

Lesson 19

The store would make money through re-selling the product (ice skates).

| Consideration | Jackson Ultima | Riedell Eclipse |

| Cost | $75 per pair | $80 per pair |

| Quality | Standard quality | Premium quality |

| Guarantee | 100% guaranteed warranty of twelve months. Free repairs are done within the warranty period. | 100% guaranteed warranty of 6 months. Free repairs are done within the warranty period. |

| Service | No shipping fees | No shipping fees |

| Money available | $75 per pair | $75 per pair |

| Product information | Good entry-level choice with advanced features on its premium models. | Good for entry-level choice. Advanced-level skates have cork heels and toe boxes. |

| Ytyle | Skater can advance from beginner's level to advanced level without changing brands. | Skater needs to change brands as he/she advances to advanced levels. |

My decision would be to buy the Jackson Ultima ice skates because they are within the allowable budget and has a longer warranty period. These ice skates are better than Riedell Eclipse because they offer customers a good deal to upgrade their boots as skill level advances, saving on their cost of acquiring a new brand.

Pairs bought=$4000$75=53 pairs of Jackson Ultima ice skates which costs $3975

Selling Price per pair=$150, hence total revenue would be $15053=$7950

Gross Profit=$7950-$3975=$3975

Net profit would be $3975-$2000=$1975

Lesson 20

Steps used to prepare a budget

Step Description

- Start keeping records: Begin recording all my expenses for a few months.

- Categorization of my expenses: I list all my expenses under specified categories that make sense to me.

- Creation of an expense record: I generate a record of previous year's monthly expenses, current year's monthly estimated expenses and leave a column for recording my actual expenses for the month.

- Creation of a monthly spending targets: I divide my yearly expenditure into 12 parts to know my monthly expenditure targets.

- Preparation of a monthly budget form: I record my total gross income for the month from all sources at the top of my form. I also record all my expenses on the three columns; the first column bears the name of expense, the second column has expenditure estimates for the month, the third column has the actual monthly expenses.

- Balancing my budget: I do this at the end of each month to ensure that what I was supposed to have left over is close to the total that I have left over.

- Budget Analysis: Examination of my budget columns to see where I may be overspending, where I can save money and see if my expense predictions are appropriate.

Personal budget

Gross Income from all sources Salary: $3800

Expense categories Monthly actual Monthly expenditures

Rent $1200 $1200

Phone $100 $100

Electricity $100 $100

Gas $300 $300

Internet $50 $50

Medical expenses $130 $100

Hair $20 $15

Clothing $200 $180

Gifts $50 $36

Meals out $600 $700

Movie tickets $44 $30

Concerts $32 $35

Fare $150 $145

Personal Savings $200 $200

Investments $300 $300

Miscellaneous $75 $60

Total expenditure $3551 $3551

I have an extra $249 not budgeted for. I can use this surplus to increase my investments and personal savings.

Cite this page

Finance Essay Sample from Our Collection. (2022, Sep 12). Retrieved from https://speedypaper.com/essays/finance-essay-sample-from-our-collection

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Literary Analysis on Death of a Salesman, Free Essay Example

- Free Essay on Physical Appearance, Social Judgment, and Identity

- Management of People - HRM Essay Sample

- The Molarity of Abortion by Mark T. Brown, Free Essay

- Counting in Preschool - Teaching Essay Example

- Free Essay Describing the Detrimental of Donald Trump's Presidency to the US

- Nutrition Essay Sample: Interview with Obese Person

Popular categories