Economic questions and answers

Question 1

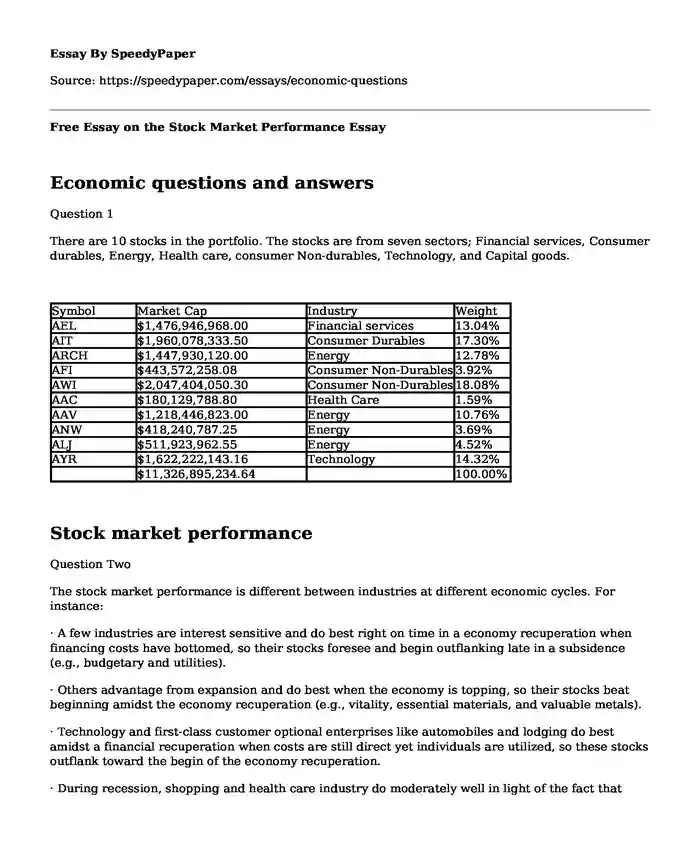

There are 10 stocks in the portfolio. The stocks are from seven sectors; Financial services, Consumer durables, Energy, Health care, consumer Non-durables, Technology, and Capital goods.

| Symbol | Market Cap | Industry | Weight |

| AEL | $1,476,946,968.00 | Financial services | 13.04% |

| AIT | $1,960,078,333.50 | Consumer Durables | 17.30% |

| ARCH | $1,447,930,120.00 | Energy | 12.78% |

| AFI | $443,572,258.08 | Consumer Non-Durables | 3.92% |

| AWI | $2,047,404,050.30 | Consumer Non-Durables | 18.08% |

| AAC | $180,129,788.80 | Health Care | 1.59% |

| AAV | $1,218,446,823.00 | Energy | 10.76% |

| ANW | $418,240,787.25 | Energy | 3.69% |

| ALJ | $511,923,962.55 | Energy | 4.52% |

| AYR | $1,622,222,143.16 | Technology | 14.32% |

| $11,326,895,234.64 | 100.00% |

Stock market performance

Question Two

The stock market performance is different between industries at different economic cycles. For instance:

· A few industries are interest sensitive and do best right on time in a economy recuperation when financing costs have bottomed, so their stocks foresee and begin outflanking late in a subsidence (e.g., budgetary and utilities).

· Others advantage from expansion and do best when the economy is topping, so their stocks beat beginning amidst the economy recuperation (e.g., vitality, essential materials, and valuable metals).

· Technology and first-class customer optional enterprises like automobiles and lodging do best amidst a financial recuperation when costs are still direct yet individuals are utilized, so these stocks outflank toward the begin of the economy recuperation.

· During recession, shopping and health care industry do moderately well in light of the fact that everything else that is all the more financially delicate does much more awful, so these stocks beat close to the economy pinnacle.

Question Three

The historical period used in the computations is between January, 1 2016 and November, 7 2016.

AEL

| Date | Adj Close | Return | Date | Adj Close | Return | Beta |

| 11/1/2016 | 15.93 | -0.11154 | 11/1/2016 | 2085.18 | -0.01927 | 4.045032 |

| 10/3/2016 | 17.93 | 0.01128 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 17.73 | 0.006243 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 17.62 | 0.106089 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 15.93 | 0.117895 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 14.25 | -0.12091 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 16.21 | 0.157857 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 14 | -0.16667 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 16.8 | 0.235294 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 13.6 | -0.25234 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 18.19 | 1/4/2016 | 1940.24 |

AIT

| Date | Adj Close | Date | Adj Close | Beta | ||

| 11/1/2016 | 49.2 | -0.0315 | 11/1/2016 | 2085.18 | -0.01927 | 1.093207 |

| 10/3/2016 | 50.8 | 0.086863 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 46.74 | -0.01641 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 47.52 | 0.018034 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 46.67822 | 0.040098 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 44.8787 | -0.00133 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 44.93835 | -0.00751 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 45.27846 | 0.055991 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 42.8777 | 0.127273 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 38.03667 | 0.008774 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 37.70585 | 1/4/2016 | 1940.24 |

ARCH

| Date | Adj Close | Return | Date | Adj Close | Return | Beta | |

| ARCH | 11/1/2016 | 68 | -0.07332 | 11/1/2016 | 2085.18 | -0.01927 | 0.526038 |

| 10/3/2016 | 73.38 | 0.046492 | 10/3/2016 | 2126.15 | -0.01943 | ||

| 9/1/2016 | 70.12 | -0.00142 | 9/1/2016 | 2168.27 | -0.00123 | ||

| 8/1/2016 | 70.22 | 0.017681 | 8/1/2016 | 2170.95 | -0.00122 | ||

| 7/1/2016 | 69 | 0.014706 | 7/1/2016 | 2173.6 | 0.03561 | ||

| 6/1/2016 | 68 | 0.005917 | 6/1/2016 | 2098.86 | 0.000911 | ||

| 5/3/2016 | 67.6 | 0.117355 | 5/2/2016 | 2096.95 | 0.015325 | ||

| 4/1/2016 | 60.5 | 0.018519 | 4/1/2016 | 2065.3 | 0.002699 | ||

| 3/1/2016 | 59.4 | 0.03125 | 3/1/2016 | 2059.74 | 0.065991 | ||

| 2/1/2016 | 57.6 | 0.034669 | 2/1/2016 | 1932.23 | -0.00413 | ||

| 1/4/2016 | 55.67 | 1/4/2016 | 1940.24 |

AFI

| Date | Adj Close | Return | Date | Adj Close | Return | |

| 11/1/2016 | 15.64 | -0.03397 | 11/1/2016 | 2085.18 | -0.01927 | 5.276814 |

| 10/3/2016 | 16.19 | -0.14248 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 18.88 | -0.08438 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 20.62 | 0.034621 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 19.93 | 0.175811 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 16.95 | 0.0217 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 16.59 | 0.139423 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 14.56 | 0.10303 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/17/2016 | 13.2 | 3/1/2016 | 2059.74 |

AWI

| Date | Adj Close | Date | Adj Close | |||

| 11/1/2016 | 36.75 | -0.02 | 11/1/2016 | 2085.18 | -0.01927 | 2.90003 |

| 10/3/2016 | 37.5 | -0.09245 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 41.32 | -0.04946 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 43.47 | 0.023546 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 42.47 | 0.084802 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 39.15 | -0.0532 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 41.35 | 0.013232 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 40.81 | -0.1563 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 48.37 | 0.193437 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 40.53 | 0.047828 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 38.68 | 1/4/2016 | 1940.24 |

AAC

| Date | Adj Close | Return | Date | Adj Close | Return | |

| 11/1/2016 | 7.51 | -0.54179 | 11/1/2016 | 2085.18 | -0.01927 | 2.372906 |

| 10/3/2016 | 16.39 | -0.0575 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 17.39 | -0.11094 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 19.56 | -0.13719 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 22.67 | -0.00657 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 22.82 | 0.060902 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 21.51 | 0.044682 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 20.59 | 0.040424 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 19.79 | -0.0299 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 20.4 | 0.142217 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 17.86 | 1/4/2016 | 1940.24 |

AAV

| Date | Adj Close | Return | Date | Adj Close | Return | Beta |

| 11/1/2016 | 6.4 | -0.05185 | 11/1/2016 | 2085.18 | -0.01927 | 1.879592 |

| 10/3/2016 | 6.75 | -0.03983 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 7.03 | 0.029283 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 6.83 | 0.075591 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 6.35 | 0.135957 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 5.59 | -0.05093 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 5.89 | 0.02972 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 5.72 | 0.041894 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 5.49 | 0.08284 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 5.07 | -0.07143 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 5.46 | 1/4/2016 | 1940.24 |

ANW

| Date | Adj Close | Return | Date | Adj Close | Return | Beta |

| 11/1/2016 | 8.25 | -0.0407 | 11/1/2016 | 2085.18 | -0.01927 | 1.355462 |

| 10/3/2016 | 8.6 | -0.14 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 10 | 0.001001 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 9.99 | 0.535075 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 6.507824 | 0.185455 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 5.489729 | -0.17152 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 6.626291 | -0.17164 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 7.999306 | 0.062087 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 7.531685 | 0.058611 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 7.114686 | 0.007022 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 7.065072 | 1/4/2016 | 1940.24 |

ALJ

| Date | Adj Close | Return | Date | Adj Close | Return | Beta |

| 11/1/2016 | 7.17 | -0.11042 | 11/1/2016 | 2085.18 | -0.01927 | 1.308924 |

| 10/3/2016 | 8.06 | 0 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 8.06 | -0.01467 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 8.18 | 0.180646 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 6.928411 | 0.091049 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 6.350227 | -0.14172 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 7.398799 | -0.26764 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 10.10263 | 0.017442 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 9.929445 | 0.046653 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 9.486854 | -0.20461 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 11.9273 | 1/4/2016 | 1940.24 |

AYR

| Date | Adj Close | Return | Date | Adj Close | Return | Beta |

| 11/1/2016 | 20.37 | -0.00876 | 11/1/2016 | 2085.18 | -0.01927 | 1.431672 |

| 10/3/2016 | 20.55 | 0.034743 | 10/3/2016 | 2126.15 | -0.01943 | |

| 9/1/2016 | 19.86 | -0.08268 | 9/1/2016 | 2168.27 | -0.00123 | |

| 8/1/2016 | 21.65 | -0.0148 | 8/1/2016 | 2170.95 | -0.00122 | |

| 7/1/2016 | 21.97515 | 0.135992 | 7/1/2016 | 2173.6 | 0.03561 | |

| 6/1/2016 | 19.34446 | -0.07474 | 6/1/2016 | 2098.86 | 0.000911 | |

| 5/2/2016 | 20.90705 | -0.01489 | 5/2/2016 | 2096.95 | 0.015325 | |

| 4/1/2016 | 21.22298 | -0.02428 | 4/1/2016 | 2065.3 | 0.002699 | |

| 3/1/2016 | 21.75111 | 0.108674 | 3/1/2016 | 2059.74 | 0.065991 | |

| 2/1/2016 | 19.61903 | 0.182997 | 2/1/2016 | 1932.23 | -0.00413 | |

| 1/4/2016 | 16.58417 | 1/4/2016 | 1940.24 |

Portfolio Beta

To compute the portfolio beta, the weights of each of the stock in the portfolio is multiplied with the stock beta. The formula is shown below; Where is the weight of stock i in the portfolio.

| Symbol | Market Cap | Industry | Weight |

| AEL | $1,476,946,968.00 | Financial services | 13.04% |

| AIT | $1,960,078,333.50 | Consumer Durables | 17.30% |

| ARCH | $1,447,930,120.00 | Energy | 12.78% |

| AFI | $443,572,258.08 | Consumer Non-Durables | 3.92% |

| AWI | $2,047,404,050.30 | Consumer Non-Durables | 18.08% |

| AAC | $180,129,788.80 | Health Care | 1.59% |

| AAV | $1,218,446,823.00 | Energy | 10.76% |

| ANW | $418,240,787.25 | Energy | 3.69% |

| ALJ | $511,923,962.55 | Energy | 4.52% |

| AYR | $1,622,222,143.16 | Technology | 14.32% |

| $11,326,895,234.64 | 100.00% | ||

| Computations | |||

| Portfolio Beta | 2.069169834 |

Observations on Beta

Beta is considered a measure of the volatility, or systematic risk, of an investment program or security in comparison to a benchmark index. The beta is a measure of the systematic or volatility because of exposure to market movements as opposed to individual security factors. A portfolio systematic risk and volatility measure is considered as beta if it is compared with the benchmark index. A portfolio beta can be high or low when compared with the index. Basically, higher beta compared with index means the portfolio price performance is better. In addition, when a portfolio performance is lower it means that its price performance as compared with the index is lower. Notably, portfolio relative weakness and strength is detected by the beta it has.

Investment beta is computed comparing it with the index, for instance S&P index. When an investment’s beta is 1.5, it basically means that the portfolio is 50% more volatile than the index it is compared with. If investment’s beta is compared with the index, then either the investment will lose or gain by 50%.

Cite this page

Free Essay on the Stock Market Performance. (2017, Dec 20). Retrieved from https://speedypaper.com/essays/economic-questions

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- What Are the Advantages of the Internet Essay Sample

- Free Essay Sample on National Health Authority

- Free Essay on How Social Media and Other Technologies Influences How We Worm Identities

- Essay Sample on New Approaches in The School Curriculum

- Paper Example on Contrasting Attitudes on the Subject of Abortion

- Paper Example. Serotonin Norepinephrine Reuptake Inhibitors Drug

- Essay Sample on Repositioning and Pressure Redistribution Mattress in Preventing Pressure Ulcers

Popular categories