| Type of paper: | Essay |

| Categories: | Management Accounting |

| Pages: | 2 |

| Wordcount: | 540 words |

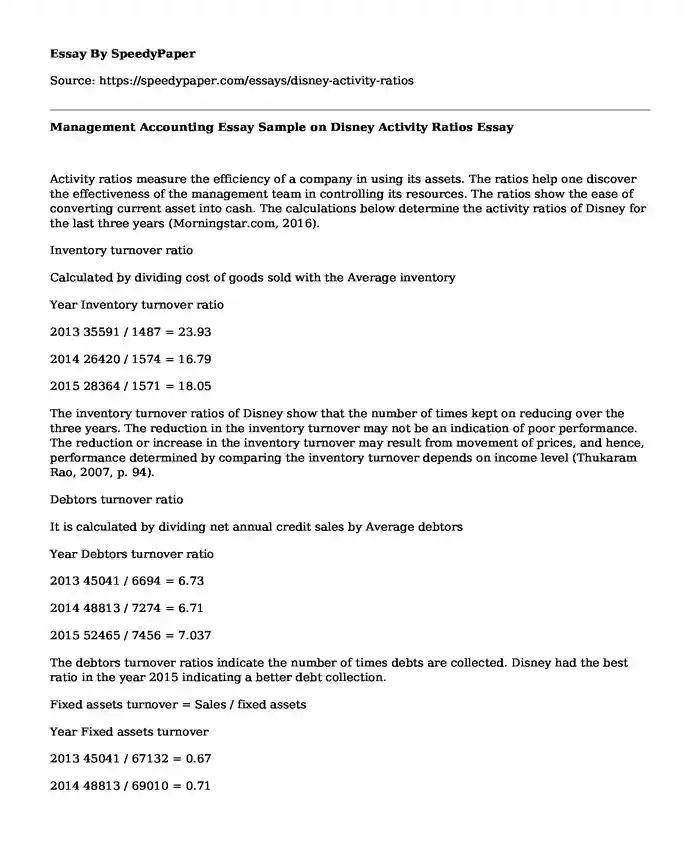

Activity ratios measure the efficiency of a company in using its assets. The ratios help one discover the effectiveness of the management team in controlling its resources. The ratios show the ease of converting current asset into cash. The calculations below determine the activity ratios of Disney for the last three years (Morningstar.com, 2016).

Inventory turnover ratio

Calculated by dividing cost of goods sold with the Average inventory

Year Inventory turnover ratio

2013 35591 / 1487 = 23.93

2014 26420 / 1574 = 16.79

2015 28364 / 1571 = 18.05

The inventory turnover ratios of Disney show that the number of times kept on reducing over the three years. The reduction in the inventory turnover may not be an indication of poor performance. The reduction or increase in the inventory turnover may result from movement of prices, and hence, performance determined by comparing the inventory turnover depends on income level (Thukaram Rao, 2007, p. 94).

Debtors turnover ratio

It is calculated by dividing net annual credit sales by Average debtors

Year Debtors turnover ratio

2013 45041 / 6694 = 6.73

2014 48813 / 7274 = 6.71

2015 52465 / 7456 = 7.037

The debtors turnover ratios indicate the number of times debts are collected. Disney had the best ratio in the year 2015 indicating a better debt collection.

Fixed assets turnover = Sales / fixed assets

Year Fixed assets turnover

2013 45041 / 67132 = 0.67

2014 48813 / 69010 = 0.71

2015 52465 / 71424 = 0.73

They show the utilization of the fixed assets in the operations of the company. Disney utilization of the fixed assets in the generation of sales improved over the three years.

Total assets turnover = sales / total assets

Year Total assets turnover

2013 45041/ 81241 = 0.55

2014 48813 / 84186 = 0.58

2015 52465 / 88182 = 0.59

The ratios indicate that the company utilization of the total assets improved over the three years. The ratios were relatively low but with the year 2015 having the highest in the three years.

Debt collection period

It is calculated by dividing the number of days in a year by debt turnover

Year Debt collection period

2013 365 / 6.73 = 54.23

2014 365 / 6.71 = 54.40

2015 365 / 7.04 = 51.85

The debt collection period was 54 days in the years 2013 and 2014 while in 2015 it was 51 days. It shows there was an improvement in the debt collection period in the year 2015.

Days inventory outstanding

Year Days inventory outstanding

2013 365 / 23.93 = 15.25

2014 365 / 16.79 = 21.74

2015 365 / 18.05 = 20.22

Disney had the lowest and the best inventory outstanding period in the year 2013. The outstanding days shows the days that the inventory stays in the stores of the company before it is sold.

As a manager at Disney, I would like to investigate the debt collection period and the assets utilization. I would aim at improving the debt collection period to increase the liquidity of the firm. I would also wish to investigate the assets utilization to ensure that assets are efficiently used.

I would request to see the debtors agreement and information regarding the creditors. The information would help in finding out whether the debt collections periods are followed and if the set debt limits implemented. The creditors information would assist in understanding the liquidity of the firm better.

I would invest money in the company as a result of the activity ratio analysis. The ratios show that the company is doing relatively well in the utilization of assets. I would, however, wish to do further analysis to ensure the company is doing well in the other areas of its operation like the profitability ratios.

References

Balance Sheet for Walt Disney Co (DIS) from Morningstar.com. (2016). Financials.morningstar.com. Retrieved 5 April 2016, from <http://financials.morningstar.com/balance-sheet/bs.html?t=DIS®ion=usa&culture=en-US>

Thukaram Rao, M. (2007). Management Accounting. New Delhi: New Age.

Cite this page

Management Accounting Essay Sample on Disney Activity Ratios. (2019, Aug 15). Retrieved from https://speedypaper.com/essays/disney-activity-ratios

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Example on How Analytics Can Be Used to Fight Frauds

- Walmart Analysis Essay Sample

- Essay Sample on Customer Relationship Management

- Free Essay for Students: Listening

- Free Essay on Current Global Events and Oral Presentation: The 2018 World Cup

- Paper Example on Women in the Workplace: Enhancing Performance Through Diversity

- Theories of Development. Paper Example

Popular categories