| Type of paper: | Essay |

| Categories: | Business plan |

| Pages: | 5 |

| Wordcount: | 1232 words |

My business idea belongs to the bottled water industry. I am looking to sell bottled water in refillable cans that will also be able to refill themselves. It is all about convenience in the whole package. The industry name is Bottled Water Manufacturing, classified under NAICS code 424490. My business fits in this industry because I plan to bottle and sell purchased purified water. The categories in this industry include manufacturing and bottling water, selling manufactured purified water and purifying naturally carbonated water and bottling it.

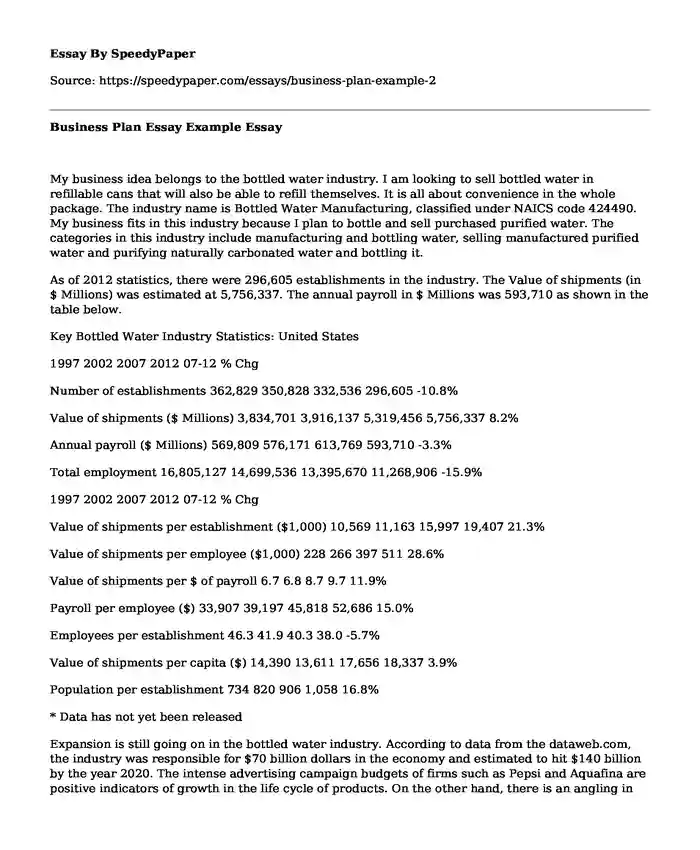

As of 2012 statistics, there were 296,605 establishments in the industry. The Value of shipments (in $ Millions) was estimated at 5,756,337. The annual payroll in $ Millions was 593,710 as shown in the table below.

Key Bottled Water Industry Statistics: United States

1997 2002 2007 2012 07-12 % Chg

Number of establishments 362,829 350,828 332,536 296,605 -10.8%

Value of shipments ($ Millions) 3,834,701 3,916,137 5,319,456 5,756,337 8.2%

Annual payroll ($ Millions) 569,809 576,171 613,769 593,710 -3.3%

Total employment 16,805,127 14,699,536 13,395,670 11,268,906 -15.9%

1997 2002 2007 2012 07-12 % Chg

Value of shipments per establishment ($1,000) 10,569 11,163 15,997 19,407 21.3%

Value of shipments per employee ($1,000) 228 266 397 511 28.6%

Value of shipments per $ of payroll 6.7 6.8 8.7 9.7 11.9%

Payroll per employee ($) 33,907 39,197 45,818 52,686 15.0%

Employees per establishment 46.3 41.9 40.3 38.0 -5.7%

Value of shipments per capita ($) 14,390 13,611 17,656 18,337 3.9%

Population per establishment 734 820 906 1,058 16.8%

* Data has not yet been released

Expansion is still going on in the bottled water industry. According to data from the dataweb.com, the industry was responsible for $70 billion dollars in the economy and estimated to hit $140 billion by the year 2020. The intense advertising campaign budgets of firms such as Pepsi and Aquafina are positive indicators of growth in the life cycle of products. On the other hand, there is an angling in profitability margins compared to previous years mainly due to move from bulk to bottled water. A steadily emerging trend in the industry is the appearance of highly priced enhanced waters, which pose competition at the product category level. The enhanced waters rapidly multiply profit when bought as compared to other non-premium brands. Moreover, the enhanced waters are sold via aggressive marketing campaigns and combined with health minding trends avail a large market share for companies which can use the power to raise their products to generic competition levels.

On the other hand, growth in the bottled water industry has continued steadily (+20.1%), compared to last years +19.5%. the pricing of category growth was +.07% in contrast to +1.6% last year. On average, pricing for some of the brands went down by -6% presently compared to the preceding years -7%. The price of players such as Pepsis products declined by an average of 14%, Aquafina was down 13.8% and Propel was down 8%. Aquafina pricing demonstrated indications of stability in the previous periods and was positive for two straight months. Pepsi water volume sales rose by 57%, spurred by a 27% rise from Propel and a 61% rise in Aquafina. Overall pricing of Coke was down 9.8% compared to the preceding years -6.8%, mainly attributed to 20.9% rise in Dasani. Total volume of Coke sales experienced 28.8% growth compared to a difficult upward tread from the previous year. Dasani sales grew 26.2% compared to the previous years 38%.

The bottled water industry continues to experience the effects of increased promotional activity. A five year high in sales was achieved during Memorial Day weekend promotions. The volume of Pepsi sold on promotion was up to 82%, up from 74% in the previous period. Coke experienced a decline from 73% to 70%. However, the averages were up for them. Annually, the percentage volume sold during promotion in the water industry tends to rise. Despite the lower margins and rising cost of packaging, the level of promotional activity may not yield profit I the long run. The sustainability of such activity is in doubt.

Historically, Pepsis promotional activity in the water industry has been much more competitive than its main competition, Coke (in the same category). The promotional activities have consistently spurred gains in share market though not really at Cokes expense. In the duration of the past five years, the promotional activity undertaken by Pepsi has outrun Cokes by an average 6%. These figures have inspired forward volume movement for Pepsi in share gains every month. Most recently, the promotional activity by Pepsi as a percentage of volume beat Coke by 12%, chiefly obtaining from private label. Given the questionable aspect of profitability at this volume, and the level Pepsi promotes compared to its nearest competition, it is evident that Pepsi has no future plans to let go of its share in the water category its clear the

Competition includes, but is not limited to Fiji, Evian, Arrowhead, Sparkletts, and Dasani, Dannone, and Aquafina water. These companies are major players. In addition, they compete for a share of the market at the consumers level for products in the same line. Cold drinks such as Health Oriented Thirst Quenchers, almost any water, orange juice, Vitamin Water, Sobe [sport] water; Propel, Gatorade, and SmartWater compete with my product in the product category. The competition they pose in the same line of product is at the health oriented consumer level. In addition, there is generic competition from beverages such as lemon-limes, juices, sodas, diet soda, fruit flavored sodas, colas, diet colas, coffee, tea, wine, and beer. These generic products provide direct competition with my product at the consumers level for generic beverages. Budget competitors also exist in the market. They provide alternative refreshment sometimes at a lower cost. They include fast-food and ice-cream. They compete at the consumer level for the availability of money supply which the consumer also needs to spend on other things to satisfy their needs/ wants.

Subject United States

Estimate Margin of Error Percent Percent Margin of Error

SEX AND AGE

Total population 311,536,594 ***** 311,536,594 (X)

Male 153,247,412 +/-6,859 49.2% +/-0.1

Female 158,289,182 +/-6,862 50.8% +/-0.1

Under 5 years 20,052,112 +/-3,384 6.4% +/-0.1

5 to 9 years 20,409,060 +/-22,676 6.6% +/-0.1

10 to 14 years 20,672,609 +/-23,590 6.6% +/-0.1

15 to 19 years 21,715,074 +/-6,275 7.0% +/-0.1

20 to 24 years 22,099,887 +/-8,805 7.1% +/-0.1

25 to 34 years 41,711,277 +/-7,086 13.4% +/-0.1

35 to 44 years 40,874,162 +/-6,816 13.1% +/-0.1

45 to 54 years 44,506,268 +/-7,294 14.3% +/-0.1

55 to 59 years 20,165,892 +/-19,590 6.5% +/-0.1

60 to 64 years 17,479,211 +/-19,615 5.6% +/-0.1

65 to 74 years 22,957,030 +/-3,428 7.4% +/-0.1

75 to 84 years 13,220,447 +/-13,024 4.2% +/-0.1

85 years and over 5,673,565 +/-13,148 1.8% +/-0.1

Median age (years) 37.3 +/-0.1 (X) (X)

18 years and over 237,659,116 +/-6,357 76.3% +/-0.1

21 years and over 223,923,579 +/-22,635 71.9% +/-0.1

62 years and over 51,916,934 +/-16,302 16.7% +/-0.1

65 years and over 41,851,042 +/-4,246 13.4% +/-0.1

18 years and over 237,659,116 +/-6,357 237,659,116 (X)

Male 115,463,694 +/-5,294 48.6% +/-0.1

Female 122,195,422 +/-4,923 51.4% +/-0.1

65 years and over 41,851,042 +/-4,246 41,851,042 (X)

Male 18,160,481 +/-2,338 43.4% +/-0.1

Female 23,690,561 +/-2,928 56.6% +/-0.1

The total population of the target market is 311,536,594. The specific target market includes children and adults who go to school, work, or other activities such as sports or hiking. These people are in constant need of water to rejuvenate their system. A constant water supply would come in handy. Make the water cool, then that would be an added advantage. The age group of the target market is from children aged 5 to adults aged 74. This comprises an estimated 250 million people. The target market is therefore wide.

Data that supports my business idea begins with the size of the target market in the population. There is a wide market that is in need of the product because of its uniqueness. The demand is in spite of the availability of substitute products. These products do not possess the competitive edge my product has. In addition, the bottled water industry lacks such a handy innovation. Current manufacturers focus on branding their product based on purity; however, my product is based on satisfying a constant need easily and conveniently.

Works Cited

ACS DEMOGRAPHIC AND HOUSING ESTIMATES. "Results." American FactFinder. United States Census Bureau, n.d. Web. 18 Apr. 2015.

The Data Web. "Industry Snapshots." TheDataWeb - U.S. Census Bureau. U.S. Census Bureau, n.d. Web. 18 Apr. 2015.

Cite this page

Business Plan Essay Example. (2019, May 14). Retrieved from https://speedypaper.com/essays/business-plan-example-2

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

Popular categories