| Type of paper: | Research paper |

| Categories: | Company Marketing Business Starbucks |

| Pages: | 9 |

| Wordcount: | 2345 words |

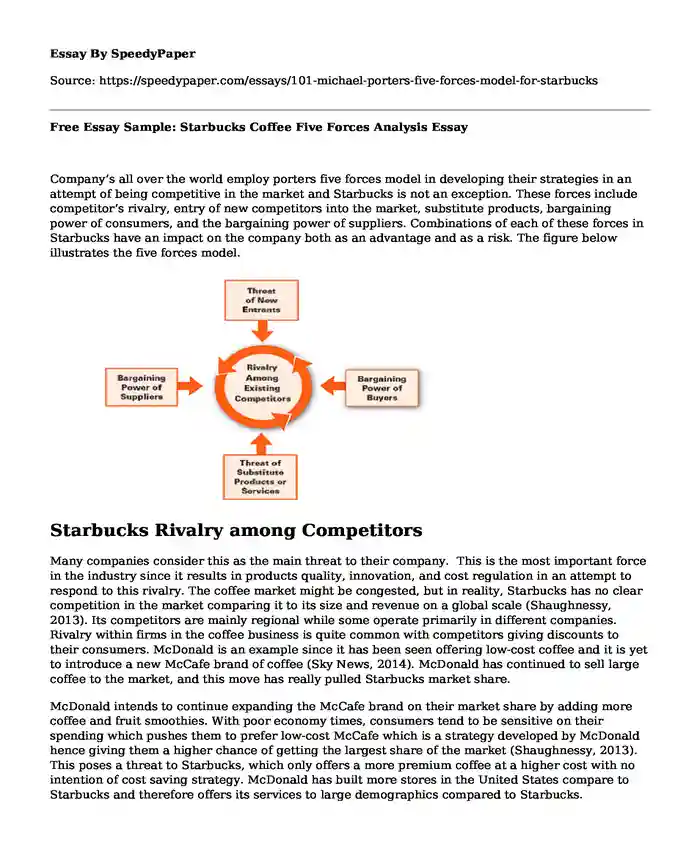

Company’s all over the world employ porters five forces model in developing their strategies in an attempt of being competitive in the market and Starbucks is not an exception. These forces include competitor’s rivalry, entry of new competitors into the market, substitute products, bargaining power of consumers, and the bargaining power of suppliers. Combinations of each of these forces in Starbucks have an impact on the company both as an advantage and as a risk. The figure below illustrates the five forces model.

Starbucks Rivalry among Competitors

Many companies consider this as the main threat to their company. This is the most important force in the industry since it results in products quality, innovation, and cost regulation in an attempt to respond to this rivalry. The coffee market might be congested, but in reality, Starbucks has no clear competition in the market comparing it to its size and revenue on a global scale (Shaughnessy, 2013). Its competitors are mainly regional while some operate primarily in different companies. Rivalry within firms in the coffee business is quite common with competitors giving discounts to their consumers. McDonald is an example since it has been seen offering low-cost coffee and it is yet to introduce a new McCafe brand of coffee (Sky News, 2014). McDonald has continued to sell large coffee to the market, and this move has really pulled Starbucks market share.

McDonald intends to continue expanding the McCafe brand on their market share by adding more coffee and fruit smoothies. With poor economy times, consumers tend to be sensitive on their spending which pushes them to prefer low-cost McCafe which is a strategy developed by McDonald hence giving them a higher chance of getting the largest share of the market (Shaughnessy, 2013). This poses a threat to Starbucks, which only offers a more premium coffee at a higher cost with no intention of cost saving strategy. McDonald has built more stores in the United States compare to Starbucks and therefore offers its services to large demographics compared to Starbucks.

In 2008, Starbucks created coffee bars in all of its store location across the world. Recently it began selling one of its premium brands in Burger King and subway restaurants at supermarkets, AMC Movie Theater and coffee houses across the country ((Sky News, 2014). This move positioned the company in a better position than its main rivals in the market such as McDonald thus intensifying the rivalry among them. Dunkin’s Donuts is also another company in the industry that offers a lower cost coffee alternative to Starbucks (Staff, 2014). The two companies are in intense competition in many locations such as Vietnam and New York City. In New York City, Starbucks and Dunkin have combined an account for more than 41% of coffee shops. Reports by New York Economic Development Corporation records that Starbucks have about 272 stores while Dunkin; Donuts have 454 stores (NYCEDC, 2013). Reports indicate that Dunkin has registered an increase in revenue generated from coffee due to the continued product innovation and marketing strategies through advertising campaigns such as “What are you Dunkin and “America Runs on Drinking?” Having over 5000 stores in the United States have made Dunkin be more competitive in the market and keeping their rivals on their feet such as Krispy Kreme and McDonald than even Starbucks (Rafii, 2013). However, this does not mean that Dunkin is not in competition with Starbucks. The franchising structure makes it able to have low overhead costs at the upper managerial levels giving the management an opportunity to focus on store development, menu innovation, and advertising. Focusing on the advertisement is what has really intensified the competition between the two firms. In 2006, Dunkin ran an ad that many customers referred to as Fritalian commercial (Reinhard, 2016). The commercial features customers pinned in coffee houses were similar to the initial setup of Starbucks shops. The ad war between Dunkin and Starbucks have existed for a long period without Starbucks being mentioned directly like coffee shops in Dunkin’ ads (Sanburn, 2012). This shows that Dunkin has positioned itself as anti-Starbucks.

However, McDonalds Company has also not stayed away from such advertisements. In 2008, McDonald ran a billboard that read, “Four bucks is a dump.” This directly means that they are targeting on Starbucks. While McDonald and Dunkin focused on advertising their new products in the market to fight against the powerhouse Starbucks. Starbuck, on the other hand, was busy working on new innovative products that will beat the competition in the market. Among these innovations were Starbucks VIA and K-Cup (Sanburn, 2012). With these new brands, Starbucks is expected to penetrate into the market and compete with other coffee manufacturers and brewers and the likes of Folgers. Recently, Starbucks has also increased its distribution channel by collaborating with Kraft foods in an attempt to increase the number of sales of its packaged coffee in the market that are mainly distributed to club warehouse stores, grocery stores, and convenience stores. The coffee shop or bar business look is one that is very easy to replicate. This makes it easy for competitors to check on your strategies and position themselves in a better position. Starbucks uses this to their advantage to help stay at the top of the game that includes having large restaurants, regional and local chains, and coffee manufacturing firms and brewers among other companies.

Potential Entry of New Starbucks Competitors

Penetrating into the coffee market is very easy. This is because everyone adores coffee so much. However, in terms of competition, it acts as a setback on Starbucks. The main factors contributing to this threat are the supply side economies of scale. When the price of ingredients used in making a cup of coffee increases then this becomes a challenge for new firms to enter into the business. Such a situation in the market was experienced in October 2012, when Tully’s coffee in Redmond decided to close down due to the rise in the price of commodities used in making coffee (Rafii, 2013). However, Starbucks has risen up to this challenge being that it is a large company. The increase of such commodities cannot lead to the shutdown of Starbucks as much as such rise can harm local chains. However, McDonald has also the benefits of enjoying the economies of scale and the slow growth of local coffee houses or even closing down since this gives McDonald the opportunity to capture their consumers by offering low-priced coffee than Starbucks (Kamenetz, 2013). Other firms that have also stabilized in the business can take advantage of supply their coffee across the world depriving Starbucks of its market share. To cushion this, Starbucks capitalizes on the advantage of having more buyers and the benefit of their network in the market. Many companies across the world have partnerships arrangement with Starbucks, which makes it even harder for new firms to enter the market and be successful. Such partnerships also make it difficult for existing coffee firms to penetrate into the market. If you happen to fly with the United Airline, there is only one choice of coffee that is Starbucks (King, 2011). At the same time, if you lodge in Sheraton hotel or shops at Nordstrom, the only brand present is Starbucks. The market strategy of trying to collaborate with other businesses ousts competitors out of the market. Starbucks being the largest restaurant in the nation and only falling in sales behind McDonald use this position to their advantage. Because of its size, it's in a capacity of out producing most of its competitors in the industry. Having over 14000 stores across the world makes Starbucks able to produce and sell more of its coffee all over the world more than other coffee shops (Levy). Most of their competitors are aware of this advantage and therefore try to keep off the market for fear of failing due to the competition they will have over Starbucks.

What Can Starbucks Do to Stay Competitive and Fight the Threats of Different Entrants?

New entrants will never stop appearing on the market. They bring not only innovations but introduce lower prices and provide fresh value propositions to the regular customers. Starbucks needs to keep up with all the newly introduced trends and build barriers to be among the leaders in the coffee industry. So, what can the corporation do to safeguard its position on the market? Here are the answers:

Innovate products that have never been previously introduced. This will not only interest the customers but help Starbucks score brownie points.

Through economies of scale, the corporation will lower the fixed price per unit.

Invest money in growth and research. Fresh players aren’t ready to spend vast amounts of money on research, while such giants as Starbucks own enough financial resources to dig out some innovative ways of conducting business.

Potential Development of Substitute Products for Coffee

Substitute goods are always a threat to businesses and Starbucks is not an exception. In order to introduce a substitute good into the market, one has to investigate why consumers use of preferring Starbucks coffee. Coffee contains a drug stimulant called caffeine, which gives human energy. On the other hand, most people just view it as a refreshing beverage. With all these factors put into consideration, one will have to produce a substitute coffee drink that is caffeinated and energy drink. A close player to the beverage industry is Coca-Cola and PepsiCo, which mainly produce soft drinks (Morriss, 2012). These two companies have for a long time produced drinks that have been preferred to a far extent by consumers than Starbucks. The low buyer switching cost in the coffee market has made customers to buy the substitute goods when they are less expensive. The substitute products are also readily available and almost sold everywhere compared to Starbucks coffee.

The figure above shows a typical shop. However, another typical aspect in this photo is the image of Diet coke advertisement just next to it. It reads,” who has time to stand in line for a latte?” coca cola has an estimated annual sales of $50 billion and PepsiCo having an estimated annual sales of $60 billion makes the two companies a bigger threat for Starbucks when these figures are compared to the annual sales of Starbucks which is estimated to be around $15billion (Murphy, 2011). The energy drink market is another industry that offers substitute goods to the market. The energy drinks normally contain stimulants that are not caffeine which have the same effect to coffee and thereby positioning themselves as substitute beverages to coffee. The industry has a number of firms including monster Beverage Corporation and Red Bull. Despite the fact that these firms are smaller than PepsiCo and Coca-Cola, they still pose a threat to Starbucks (Morriss, 2012). However, the competition among Starbucks and energy giving drinks is less compared to the soft drink industry.

Bargaining Power of Buyers in Retail Snacks and Coffee Industry

This factor is as well important when it comes to the competitive advantage of any business. When a market has powerful buyers who are ready to receive a product for the value of their money, then it ultimately reduces the profit margins of a company. When consumers tend to force prices down and bargain for the improved quality of products and services, then this leads to more competition into the industry (Kamenetz, 2013). As a result, this leads to diminished industry profitability. The bargaining power of Starbucks customers is not very high due to a few factors put in place by Starbucks.

While considering the bargaining force of buyers in a specific market, it is vital to consider their negotiating influence. A couple of huge buyers would have a favorable position in this circumstance over a market that has a few million purchasers. For Starbucks, the last is the situation. Starbucks has numerous clients, as demonstrated by its yearly income. Their clients incorporate both people and different organizations. Since coffee is a product enjoyed by many, the clients are copious. There are an expected 66 billion cups of coffee consumed yearly in the United States (Kamenetz, 2013). With this numbers, it is difficult for buyers to have higher bargaining power. However, when theses consumers speak with one voice, Starbucks is obliged to listen to them.

Figure 5 shows picketers protesting Starbucks over their alleged tax-evading procedures.

It was reported that the company had evaded in paying the corporate tax in the UK. Such actions by consumers push Starbucks to their knees forcing them to make changes. With the large customer base, Starbucks have the capability of lowering their consumer's bargaining power by offering differentiated products from their rivals. Starbucks uses Arabica beans, which are of higher quality while their competitors use low-quality coffee to meet their low-cost strategy needs (My Starbucks Idea, 2014).

Bargaining Power of Suppliers Starbucks

The final force of competitive analysis is the bargaining power of suppliers. Suppliers can only have a higher bargaining power when they are a few of them in industry, or certain suppliers own large portions of supplies required to produce a product. In the situation of Starbucks, their suppliers do not have much bargaining power in the coffee industry mainly because Starbucks works mainly with many small firms and in many cases, they are their only customers.

Starbucks keeps up sound associations with their farmers by arranging long-term contracts and regularly helping the agriculturists by giving credits to help them secure the assets expected to collect a satisfactory measure of Arabica beans for Starbucks' exceptional coffee (Morriss, 2012). Starbucks' nearness in these zones is normally useful for the farmers, as well as useful for the whole group and occasionally the whole nation. For instance, numerous agriculturists and natives of India were thrilled at the declaration that Starbucks would grow their operations in the nation through a joint wander with Tata Global Beverages the declaration that Starbucks would extend their operations in the nation through a joint venture with Tata Global Beverages (Murphy, 2011).

Cite this page

Free Essay Sample: Starbucks Coffee Five Forces Analysis. (2018, Apr 11). Retrieved from https://speedypaper.com/essays/101-michael-porters-five-forces-model-for-starbucks

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay with Cargo Airlines Research

- Free Essay with the Gene Transformation Lab Report

- Presentation Outline Assignment: Health and Wellness of Society

- Essay Sample on Health Care Funding in United States of America

- Essay Sample on Personal Statement for Ph.D. in Chemistry

- Psychological Effects of Cancer and Diabetes - Paper Example

- Essay Example on Plans for Collecting and Reporting Data of the RAMS Project

Popular categories