| Type of paper: | Report |

| Categories: | Finance Financial analysis |

| Pages: | 4 |

| Wordcount: | 864 words |

Apple Incorporation is a company that was founded in the year 1976 by Steve Wozniak and Steve jobs that were college dropouts. Since then, it has been delivering value throughout the years through the innovation of feasible products; from computers to I phones and so on. Although there is an absence of a growth catalyst, Apple still generates enormous cash flows and has been successful in maintaining a healthy balance sheet. Moreover, the company has been able to keep a consistent top and bottom high, year in, year out. The stock prices for the company have increased gradually ever since the first launch of the iPhone in 2007; going up to about 94 percent increase. The cash flow statement will provide information about the cash receipts, payments and linking them to the balance at the start to the end of the accounting period for Apple Inc.

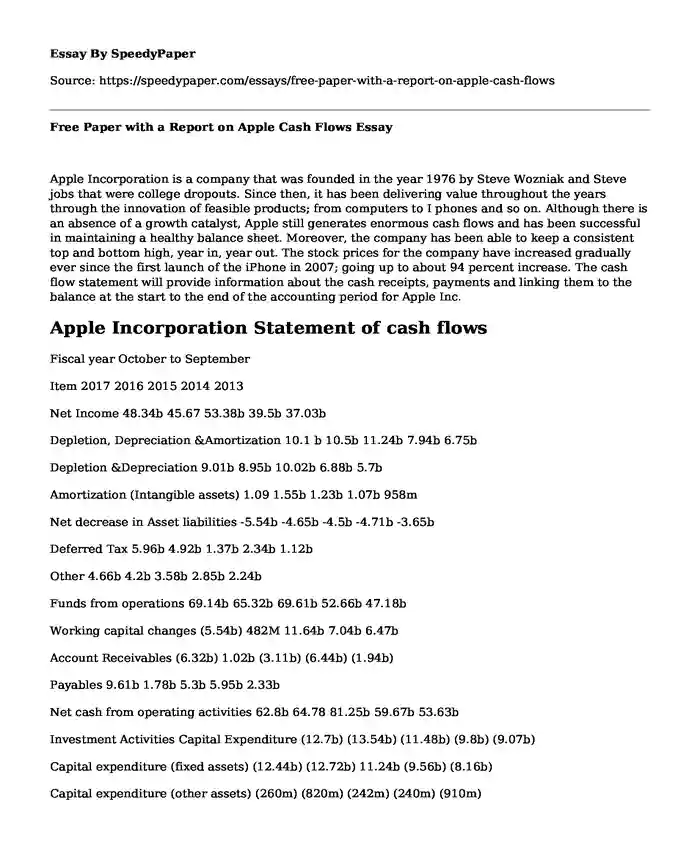

Apple Incorporation Statement of cash flows

Fiscal year October to September

Item 2017 2016 2015 2014 2013

Net Income 48.34b 45.67 53.38b 39.5b 37.03b

Depletion, Depreciation &Amortization 10.1 b 10.5b 11.24b 7.94b 6.75b

Depletion &Depreciation 9.01b 8.95b 10.02b 6.88b 5.7b

Amortization (Intangible assets) 1.09 1.55b 1.23b 1.07b 958m

Net decrease in Asset liabilities -5.54b -4.65b -4.5b -4.71b -3.65b

Deferred Tax 5.96b 4.92b 1.37b 2.34b 1.12b

Other 4.66b 4.2b 3.58b 2.85b 2.24b

Funds from operations 69.14b 65.32b 69.61b 52.66b 47.18b

Working capital changes (5.54b) 482M 11.64b 7.04b 6.47b

Account Receivables (6.32b) 1.02b (3.11b) (6.44b) (1.94b)

Payables 9.61b 1.78b 5.3b 5.95b 2.33b

Net cash from operating activities 62.8b 64.78 81.25b 59.67b 53.63b

Investment Activities Capital Expenditure (12.7b) (13.54b) (11.48b) (9.8b) (9.07b)

Capital expenditure (fixed assets) (12.44b) (12.72b) 11.24b (9.56b) (8.16b)

Capital expenditure (other assets) (260m) (820m) (242m) (240m) (910m)

Net assets from acquisitions (328m) (295m) (342m) (3.76b) (495m)

Sales from fixed assets& Businesses - - - - -

Sale/Purchase of investments (33.14b) (30.62b) (44.41b) (9.01b) (24.03b)

Purchase of investments (159.48b) (142.42b) (166.3b) (217.12b) (148.48b)

The maturity of investments 126.32 111.77b 121.98b 208.12b 124.44b

Other uses (394m) (1.4b) (25m) - (159m)

Other sources 218m - - 15m -

Net cash flow (investing) (46.41b) (44.91b) (56.27b) (22.58b) (33.77b)

Financing Activities Dividends paid (lump sum) (12.76b) (12.14b) (11.55b) (11.12b) (10.55b)

Common dividends (12.76b) (12.14b) (11.55b) (11.12b) (10.55b)

Financial dividends - - - - -

Change in the stock of capital (32.34b) (29.22b) (34.7b) (44.26b) (22.32b)

Re-Purchase of preferred and Common stock (32.8b) (29.7b) (35.24b) (44b) (22.84b)

Sale of preferred and Common stock 554m 494m 544m 728m 528m

Revenue from stock options 554m 494m 544m 728m 528m

Other proceeds from the stock sale - - - - -

Net Reduction/ issuance Of debt 29b 22.05b 29.3b 18.26b 16.8b

Change in current debt 3.84b (396m) 2.18b 6.3b -

Change in long-term debt 25.16 b 22.43b 27.10b 11.95b 16.8b

Issuance of long-term debt 28.65b 24.94b 27.10b 11.95b 16.8b

Reduction in long-term debt (3.4b) (2.4b) - - -

Other funds (1.24b) (1.15b) (748m) (418m) (382m)

Other uses (1.86b) (1.56b) (1.4b) (1.15b) (1.07b)

Other sources 626m 406m 748m 737m 701m

Net financing cash flow (17.33b) (20.46b) 17.70b 37.54b 16.38b

Effect of the exchange rate - - - - -

Miscellaneous funds - - - - -

Net change in cash (193m) (632m) 7.26B (414m) 3.49b

Free cash flow 51.12b 52.91b 70.01b 50.10b 50.12b

Apple faces numerous weaknesses with the most dominant being that it has limited reach even of its innovations only to its users and through its platforms. Siri is also limited in terms of speed, accuracy and has to depend on other apps in order to leverage its language capabilities. As a result of encryptions, Apple Inc cannot leverage data that it has stored to make services better.

Conclusion

According to the analysis of reports by financial analysts and investment advisors Apple incorporation limited is plagued with a cash problem. Most of them agree that it has more than enough operations going on and needs to shift focus towards activities that enhance shareholder interests. Financial advisors advocate towards moving in the direction of conducting buybacks and dividends as part of the solution (Nessa, Shevlin, & Wilson, 2015). Some of the company products are just reaching their maturity levels such as the tablets and Smartphone in the developing countries markets. It generated about 64 billion in operating cash flows in the last year with the free cash flow amounting to a total of 52 US billion dollars. It shows that Apple is a highly profitable business and only needs small reinvestment needs (Nessa, Shevlin, & Wilson, 2015).

Recommendation

Apple incorporation is clearly generating a lot of money still, even though the growth rate has plummeted materially throughout the years. The company needs to expand its investment in original content in a bid to make the company stock more attractive than it is now. With an estimated projection of increase free cash flow generation of 1.33 billion dollars, apple investors can move focus from iPhone X to the outsized cash generation.

References

Duchin, R., Gilbert, T., Harford, J., & Hrdlicka, C. (2017). Precautionary savings with risky assets: When cash is not cash. The Journal of Finance, 72(2), 793-852.

Nessa, M. L., Shevlin, T. J., & Wilson, R. J. (2015). What Do Investors Infer About Future Cash Flow from Foreign Earnings for Firms with Low Average Foreign Tax Rates?.

Cite this page

Free Paper with a Report on Apple Cash Flows. (2022, May 31). Retrieved from https://speedypaper.com/essays/free-paper-with-a-report-on-apple-cash-flows

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay on Finding Inspiration for Academic Writing

- Essay Sample on the Play Fences: Significance of the Title Fences

- Free Essay: Critical Analysis of Book of Addicted to Incarceration

- Free Essay on Opportunities that Present Themselves in Our Daily Lives

- Free Essay: How Social Media Contribute to Anxiety and Depression

- Free Essay Example. Digital Storytelling

- Living Buddhism: Synthetic Essay

Popular categories