| Type of paper: | Course work |

| Categories: | Budgeting Financial management |

| Pages: | 6 |

| Wordcount: | 1620 words |

The main aim of every company is to capitalize on costs and at the same time stands in a position of generating revenue to finance its operations. In the short run, the production of the company is to minimize the indirect costs whereas in the long run, the aim of every organization needs to reduce all costs and attain sustainability in the market. One of the main roles that managers need to do in every organization is to control costs and be able to capitalize off its operations. Out of the contribution from the shareholders, it is very crucial to ensure that all the costs have been reducing so as of at the end of the operation, the assets that are owned by the company of owner's capital will aid in generating revenue (Burdekin, 2015).

Bee Corps company being a service-oriented company, as shows from the cases studies indicates that the company is facing liquidity problems despite having more operations an increased number of customer services. It shows that it has capitalized much in keeping its client base, but its management has poorly done in the control of incidental costs that arise from its operations. This report will, therefore, help in addressing various issues that the management needs to do to turn around the situation that the company is currently facing. This issue will be addressed by the three financial reports as from 2015 to 2017.

Issues to be addressed will include the revenue, costs and activity drivers that have led to an increased cost that is being incurred by the company. This issue will entail its revenue generation activities, budgeting, costs control mechanism, cost drivers and activities that need to be cut short to maintain the operations in the firm.

Revenue issues

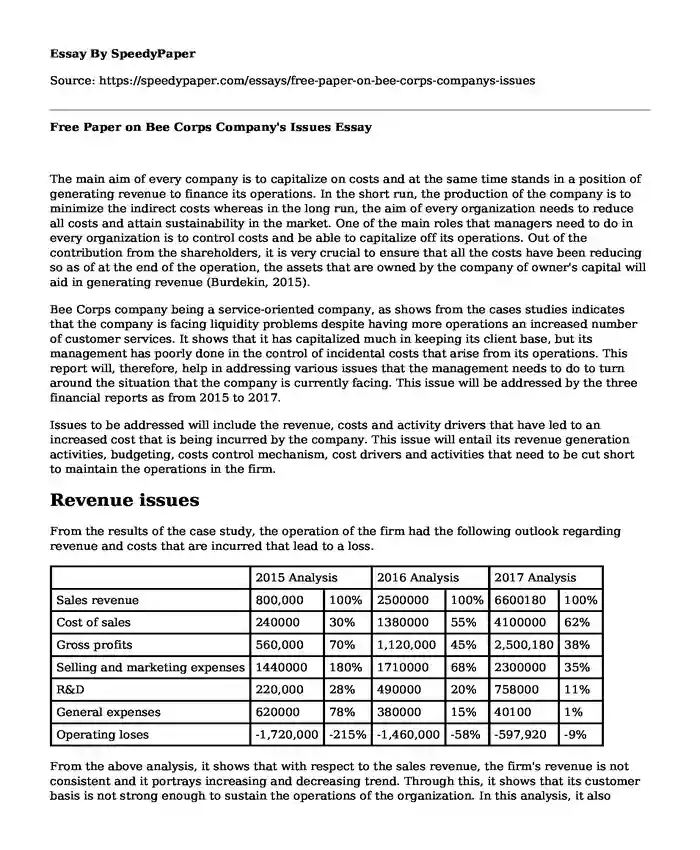

From the results of the case study, the operation of the firm had the following outlook regarding revenue and costs that are incurred that lead to a loss.

| 2015 Analysis | 2016 Analysis | 2017 Analysis | ||||

| Sales revenue | 800,000 | 100% | 2500000 | 100% | 6600180 | 100% |

| Cost of sales | 240000 | 30% | 1380000 | 55% | 4100000 | 62% |

| Gross profits | 560,000 | 70% | 1,120,000 | 45% | 2,500,180 | 38% |

| Selling and marketing expenses | 1440000 | 180% | 1710000 | 68% | 2300000 | 35% |

| R&D | 220,000 | 28% | 490000 | 20% | 758000 | 11% |

| General expenses | 620000 | 78% | 380000 | 15% | 40100 | 1% |

| Operating loses | -1,720,000 | -215% | -1,460,000 | -58% | -597,920 | -9% |

From the above analysis, it shows that with respect to the sales revenue, the firm's revenue is not consistent and it portrays increasing and decreasing trend. Through this, it shows that its customer basis is not strong enough to sustain the operations of the organization. In this analysis, it also indicates that the management of this organization is more focused on the generation of revenue by depending on the customers to attain more sales return. Since this is a service industry, it shows that as an organization, the key to success of a company needs to be based on its operation and other facilities that occur with the employees and the human resources that the company has to perform its operations, (Maiga, 2007).

One of the factors that need to be addressed on this basis is the compensation and motivation of human resources. As stated earlier that the management needs to ensure that the employees of the company are motivated so as for at the end it will stand in a position of delivering the services as needed by the company, (Johansson, 2014). One way of motivation is compensation based on the operational results. To increase the results of the company, it will be rational if the service providers are motivated, trained and also equipped with service delivery techniques so as for at the end, the management will stand in a position of maintaining the revenue base of the clients.

After training the workforce, then their ability to handle the clients will increase, and this will act as a stimulator to attain better results as far as organizations results are concerned. Their level of customer delivery will also increase, and the clients will stand in a position to offer clients the best services that will amount to better revenue and increase the revenue base of the company.

Cost drivers

Cost drivers can either be direct, indirect or incremental costs. Out of this operation, it shows the main aim of the management is to reduce costs and at the same time stands in a position of controlling its costs. One of the main ways that the company will minimize its costs is to ensure that the management budgets and plans on the cost management techniques to reduce the costs, (Libby, 2010). Out of this operation, it shows that planning it the key issue that the managing does before controlling its costs. The issues that lead to increased cost are as follows from the case study:

Beyond budgeting

This is the situation where the company management made an over budget on its operations and costs. It means that in its budgeting of costs at the beginning of every year, its budgets were made below the actual cost that would be incurred during the year. This led to an overstatement of profit that results to losses at the end of financial operations, (Libby, 2010). Beyond budgeting increases the operations and at the end of the financial statement, the company realized that its costs exceeded its operating revenue leading to a deficit that cannot be recovered.

Beyond budgeting could also have led to an increased level of costs that that resulted from accumulating losses leading to differed taxes, and other liabilities that the firm could have settled within the financial year.

Address of beyond budgeting.

To address this issue of beyond budgeting, it means that the company needs to rely on the industrial benchmark and other information from the past data of the company. Using the competitors will also help the company, make the right judgments and make relevant budgets that will have a positive variance rather than a negative variance.

The management needs also to be stewards and ensure that the costs that are incurred in research and development be minimized. These costs will be minimized through relying on the data from the government publications and other available data that will help in assessing the consumer's behavior and help the company meet these needs at the right time, (Maiga, 2007).

The management of this company should also rely on the industrial benchmark in its preparation of budgets. Using this benchmark will help the management not to overbudget, and they will prepare their cost statements based on how the industry is performing. It will also minimize the level of operations since every cost will have been planned for before being incurred.

Cost activity

From the operations and cost base of the company, we have noted that the company spends much of its costs in research and development and its aim is to meet the client's needs. Therefore, it indicates that more emphasis has been placed on the customers rather that expanding the business and making payments to the shareholders and stakeholders.

To address this issue of cost regarding the activity of the company, it will be rational if the management diversifies its risk by diversifying its operations, (Hofstede, 2012). One of the ways to mitigate this risk of increased cost is by diversification and expansion strategy. That's setting up the same business in a different location to help in increasing the rate of customer service and at the same time lowering the cost of the management. Out of this operation, it indicates that the rationale of the controllers of the company is to service its costs and increase innovation.

Creation of new customer base will help increase the revenue and at the same tome reduce the costs. Management needs also to choose a line of business clients by segregation the market so as for at the end of its operations, it will stand in a position to meet the needs arising.

Conclusion

It is therefore noted that all cost issues are vested in the decision-making authority. To mitigate this cost will entail ensuring that the management needs to make budgets, review its operations and at the same time stand in a position to control the costs. Other ways of ensuring that the company meets its operations and raise substantial costs to meet the needs of the clients are through continuous review of budgets. That is reviewing the budgets on a monthly, quarterly or yearly basis to mitigate the risk that arises from greater deviations.

It is also a call to the company management to motivate its employees by providing the right compensation and at the same time offer them the right skills to deliver the services to serve the needs of the clients. Training the employees will also help lower their fear and increase service delivery.

Finally, the approach to be done by the company to meet the needs of the clients and reduce the cost is adopted organizations policies that pertain reporting of profits, taxation, and preparation of financial statements. They need to take internationally accepted accounting principles to help them address this issue of cost. There is a higher possibility that the company does not adopt IFRS rules in preparing its statements which have led to an increase in prices. Doing this will help reduce the cost and improve the firm in meeting the dividends of the shareholders by paying out.

References

Burdekin, R. &. (2015). Budget deficits and economic performance (Routledge Revivals). . Routledge.

Hofstede, G. H. (2012). The game of budget control. New Delhi: Routledge.

Johansson, T. &. (2014). The appropriateness of tight budget control in public sector organizations facing budget turbulence. Management Accounting Research, 271-283.

Katarina estrogen and Stensaker, I. (2011). Management Control without Budgets. A Field Study of 'Beyond Budgeting' in Practice, 11(3), 149-181.

Libby, t. a. (2010). Beyond budgeting or budgeting reconsidered? In management accounting research (pp. 56-75). Northern America.

Maiga, L. k. (2007). Management accounting. Intervening effect of information Asymmetry on budget participation, 16(2012), 141-157.

Michael, A. (2005). Beyond Budgeting. Certified Institute of manage, 32, 212-249.

Cite this page

Free Paper on Bee Corps Company's Issues. (2022, Sep 28). Retrieved from https://speedypaper.com/essays/free-paper-on-bee-corps-companys-issues

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Literature Review Essay Example on Time Perception

- Free Essay with Examples of the APA Format Use for Book Citation

- Theory of Integral Nursing and Practice, Free Essay Example

- Free Essay Example: Ethical Issues Analysis Outline

- Essay Sample: Drug Testing in the Workplace

- Essay Sample: Expansion Into a New National Market

- Free Essay. the Construction Industry and Its Environmental Impact on Water Quality

Popular categories