| Type of paper: | Essay |

| Categories: | Economics Finance Accounting |

| Pages: | 3 |

| Wordcount: | 772 words |

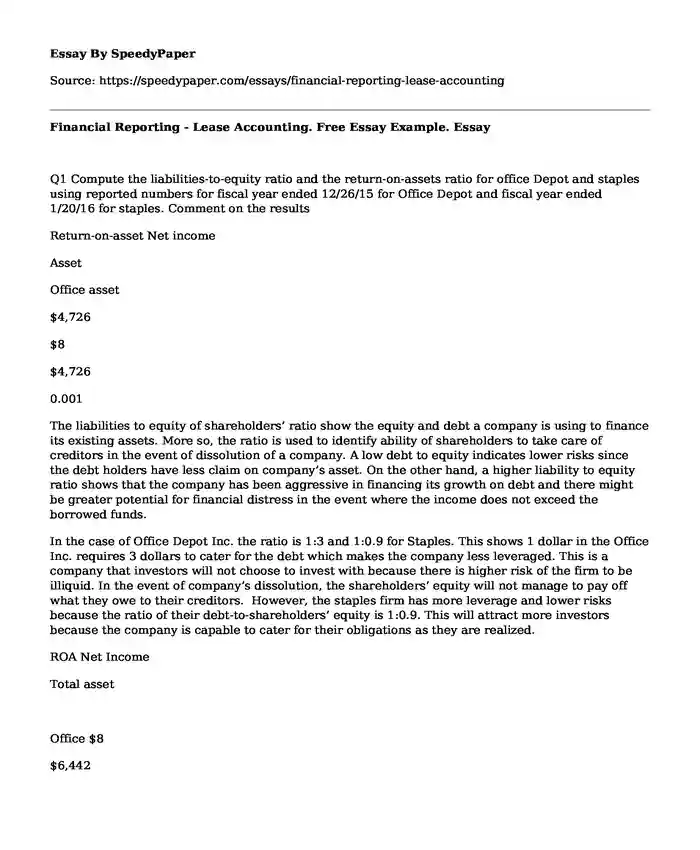

Q1 Compute the liabilities-to-equity ratio and the return-on-assets ratio for office Depot and staples using reported numbers for fiscal year ended 12/26/15 for Office Depot and fiscal year ended 1/20/16 for staples. Comment on the results

Return-on-asset Net income

Asset

Office asset

$4,726

$8

$4,726

0.001

The liabilities to equity of shareholders’ ratio show the equity and debt a company is using to finance its existing assets. More so, the ratio is used to identify ability of shareholders to take care of creditors in the event of dissolution of a company. A low debt to equity indicates lower risks since the debt holders have less claim on company’s asset. On the other hand, a higher liability to equity ratio shows that the company has been aggressive in financing its growth on debt and there might be greater potential for financial distress in the event where the income does not exceed the borrowed funds.

In the case of Office Depot Inc. the ratio is 1:3 and 1:0.9 for Staples. This shows 1 dollar in the Office Inc. requires 3 dollars to cater for the debt which makes the company less leveraged. This is a company that investors will not choose to invest with because there is higher risk of the firm to be illiquid. In the event of company’s dissolution, the shareholders’ equity will not manage to pay off what they owe to their creditors. However, the staples firm has more leverage and lower risks because the ratio of their debt-to-shareholders’ equity is 1:0.9. This will attract more investors because the company is capable to cater for their obligations as they are realized.

ROA Net Income

Total asset

Office $8

$6,442

0.001/ 0.1%

Staples $379

$10,172

0.04/ 4%

Return on Asset is also known as the return on investment. It is used to show how profitable a firm is relative to its total assets. The idea is to clearly bring out the aspect of how efficient the management is at using the firm’s asset to generate earnings. The ROA figure helps investors to understand the effectiveness of the company’s plans to convert its money to invest into net income. A higher ROA number makes the company to earn more on less investment. In the office Inc. has ROA is 0.1% and this shows that the company has a low ability at converting its investment into profit. In Staples, the ROA is 4% which shows that the management is able to convert its investment to profit. When a great consideration is put on it, the most important job of the management is to ensure that wise decisions are made and in the processes of allocation of resources. This gives anybody a chance to make a profit by investing any money at a problem, However, very few managers succeed at making large profits with little investment which is evident in the Office firm.

Q2 Convert Office Depot’s operating leases to capital leases using 7% discount rate as of the end of the fiscal year. Do the same for staples. Ignore income taxes. Show all steps. Assume that the amount of the capitalized asset equals the amount of capitalized liability.

StaplesTotal operating Lease

2013801

2014767

2015691

2016685

Accrued63

TOTAL$2,322

NPV= 2322(1-0.07)41737

Office DepotTotal operating lease

2013458

2014682

2015579

2016619

Rent expense-14

TOTAL2294

NPV=2294(1-0.07)41716

Q3 Compute the liabilities-to-equity ratio and the return-on-asset ratio for Office Depot and Staples for the latest fiscal years after converting operating leases to capital leases.

Liability-equity ratio total liability

total shareholders

Office Depot total liability

(4839+1716)

$6555

$6,555

$1,603

4.9

Staples total liability

(4782+1737)

$6519

$6519

$5384

1.2

Return-on-asset Net income

Asset

Office Asset

$4,726

(6442-1716)

$8

$4,726

0.001

Staples Asset

(10172-1737)

$8,435

$379

$8,435

0.04

Q4 Comment on the differences between the ratios from part 1 and the ration from part 3

The ratios in question 3 are higher than those in question 1 and this is due to a number of reasons. The first reason is that the high rations in question 3 show effective management of assets in the company and this proves that the assets have multiplied and helped in the growth of the company. Secondly, the higher ratios in question 3 show high expectations of the investors and this proves that investors are more willing to risk their funds in the company to help in developing the company. Finally, the differences in the ratios suggest that companies need to convert operating leases to capital leases to ensure that companies enjoy the benefits of such conversion in the business world. There is need for management of organization to highlight the benefits of capital leases foe the benefits of the society.

Cite this page

Financial Reporting - Lease Accounting. Free Essay Example.. (2017, Nov 28). Retrieved from https://speedypaper.com/essays/financial-reporting-lease-accounting

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Essay Sample: Computer Applications in the Field of Criminal Justice

- Marketing Essay Example on Product Strategy

- Essay Sample on Family Resource Management Issue

- Free Essay Sample on Extracellular Vesicles

- Free Essay: Press Release Example

- Free Essay Example. Ross Inc Financial Analysis

- Paper Example: Foundational Aspect of Strategy. Strategic Concepts

Popular categories