| Type of paper: | Problem solving |

| Categories: | Project management Financial analysis |

| Pages: | 2 |

| Wordcount: | 470 words |

Introduction of Project Theme

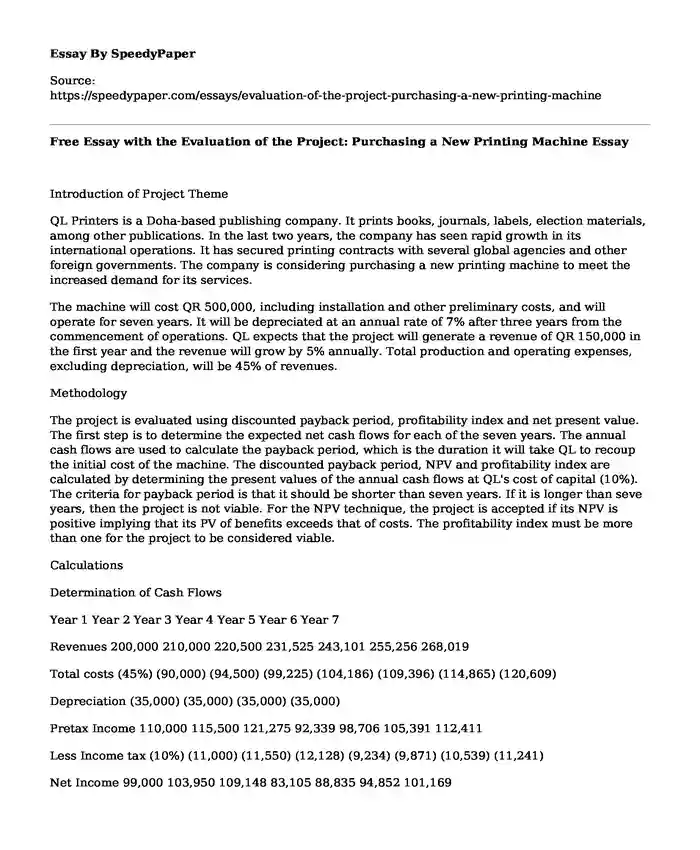

QL Printers is a Doha-based publishing company. It prints books, journals, labels, election materials, among other publications. In the last two years, the company has seen rapid growth in its international operations. It has secured printing contracts with several global agencies and other foreign governments. The company is considering purchasing a new printing machine to meet the increased demand for its services.

The machine will cost QR 500,000, including installation and other preliminary costs, and will operate for seven years. It will be depreciated at an annual rate of 7% after three years from the commencement of operations. QL expects that the project will generate a revenue of QR 150,000 in the first year and the revenue will grow by 5% annually. Total production and operating expenses, excluding depreciation, will be 45% of revenues.

Methodology

The project is evaluated using discounted payback period, profitability index and net present value. The first step is to determine the expected net cash flows for each of the seven years. The annual cash flows are used to calculate the payback period, which is the duration it will take QL to recoup the initial cost of the machine. The discounted payback period, NPV and profitability index are calculated by determining the present values of the annual cash flows at QL's cost of capital (10%). The criteria for payback period is that it should be shorter than seven years. If it is longer than seve years, then the project is not viable. For the NPV technique, the project is accepted if its NPV is positive implying that its PV of benefits exceeds that of costs. The profitability index must be more than one for the project to be considered viable.

Calculations

Determination of Cash Flows

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

Revenues 200,000 210,000 220,500 231,525 243,101 255,256 268,019

Total costs (45%) (90,000) (94,500) (99,225) (104,186) (109,396) (114,865) (120,609)

Depreciation (35,000) (35,000) (35,000) (35,000)

Pretax Income 110,000 115,500 121,275 92,339 98,706 105,391 112,411

Less Income tax (10%) (11,000) (11,550) (12,128) (9,234) (9,871) (10,539) (11,241)

Net Income 99,000 103,950 109,148 83,105 88,835 94,852 101,169

Add: Depreciation 0 0 0 35,000 35,000 35,000 35,000

Net Annual Cash Flow 99,000 103,950 109,148 118,105 123,835 129,852 136,169

PayBack Period

Year Cash flow Cumulative Cash flow

0 (500,000) (500,000)

1 99,000 (401,000)

2 103,950 (297,050)

3 109,148 (187,903)

4 118,105 (69,798)

5 123,835 54,037

6 129,852 183,889

7 136,169 320,059

Payback period = 4 years + 69,798123,835= 4 + 0.5636

= 4.5636 years or 4 years 7 months

Discounted PayBack Period

Year Cash flow Pv of QR 1 @10% PV of Cash flow Cumulative PV

0 (500,000) 1.0000 (500,000) (500,000)

1 99,000 0.9091 90,001 (409,999)

2 103,950 0.8264 85,904 (324,095)

3 109,148 0.7513 82,003 (242,092)

4 118,105 0.6830 80,666 (161,427)

5 123,835 0.6209 76,889 (84,537)

6 129,852 0.5645 73,301 (11,236)

7 136,169 0.5132 69,882 58,646

Discounted Payback period = 6 years + 11,23669,882= 6 + 0.1608

= 6.1608 years or 6 years 2 months

Net Present Value

Year Cash flow PV of QR 1 @10% PV of Cash flow

1 99,000 0.9091 90,001

2 103,950 0.8264 85,904

3 109,148 0.7513 82,003

4 118,105 0.6830 80,666

5 123,835 0.6209 76,889

6 129,852 0.5645 73,301

7 136,169 0.5132 69,882

Sum 558,646

NPV = 558,646 - 500,000

= QR 58,646

Profitability Index

Profitability Index = Sum of PV of net cash flowsCost= 558,646500,000= 1.117

Decision

I accept the project since it is viable. As shown in the above calculations, the NPV of the machine is positive implying that its PV of costs will be less than the PV of benefits. Both the Payback and Discounted Payback Periods are shorter than seven years indicating that QL will recoup the initial investment before the end of the machine's useful life. The profitability index is higher than one hence the project will generate a higher net cash flow per Qatar Riyal of the initial cost of the machine.

References:

Cite this page

Free Essay with the Evaluation of the Project: Purchasing a New Printing Machine. (2022, Apr 12). Retrieved from https://speedypaper.com/essays/evaluation-of-the-project-purchasing-a-new-printing-machine

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Political Liberty - Free Paper Example with an Annotated Bibliography

- The Best Classroom - Article Analysis Essay Sample

- Free Essay for Students: Contemporary Issues in Health and Social Care

- Essay Sample about Supervised Machine Learning Approach

- Essay Example: Substance Abuse Effects on Neonate

- Paper Example. Should violent and offensive content be removed from the Internet?

- Essay on From Haiti to Project Management: A Scholar's Journey and Vision for Housing Solutions

Popular categories