| Type of paper: | Essay |

| Categories: | Budgeting Financial analysis |

| Pages: | 6 |

| Wordcount: | 1381 words |

Capital budgeting is all about estimating the project's expected cash flows. Cash flows are determined by calculating the project's expected net income, then adjusting for non-cash items such as depreciation. The initial outlay includes the cost of the building and equipment, as well as the net change in net working capital. In this case, the total initial cash outlay is $1 billion. The net cash inflows (project's cash free cash flows) will change in each of the four years since sales are expected to increase by 5% annually.

Cost of Capital and the Capital Asset Pricing Model

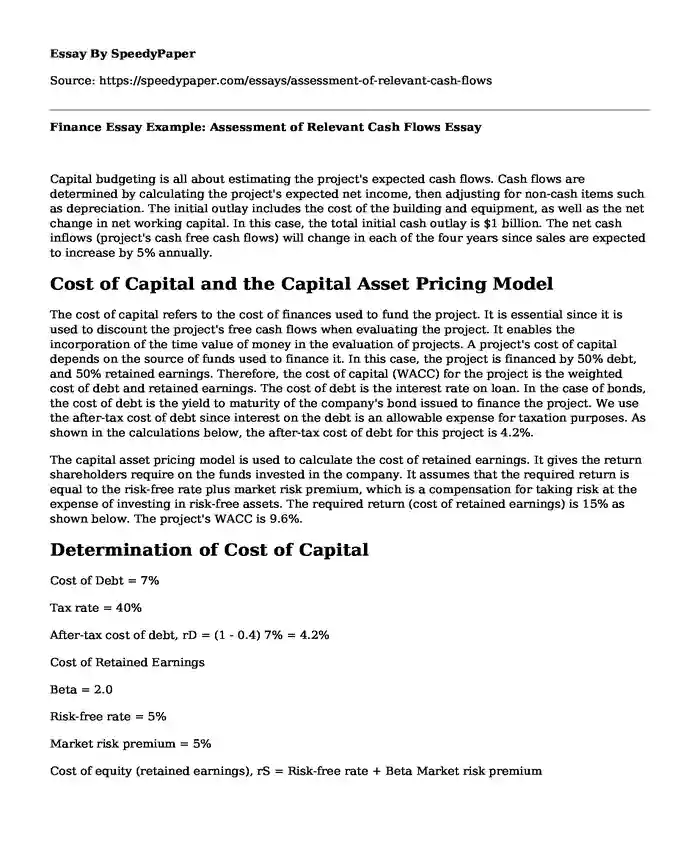

The cost of capital refers to the cost of finances used to fund the project. It is essential since it is used to discount the project's free cash flows when evaluating the project. It enables the incorporation of the time value of money in the evaluation of projects. A project's cost of capital depends on the source of funds used to finance it. In this case, the project is financed by 50% debt, and 50% retained earnings. Therefore, the cost of capital (WACC) for the project is the weighted cost of debt and retained earnings. The cost of debt is the interest rate on loan. In the case of bonds, the cost of debt is the yield to maturity of the company's bond issued to finance the project. We use the after-tax cost of debt since interest on the debt is an allowable expense for taxation purposes. As shown in the calculations below, the after-tax cost of debt for this project is 4.2%.

The capital asset pricing model is used to calculate the cost of retained earnings. It gives the return shareholders require on the funds invested in the company. It assumes that the required return is equal to the risk-free rate plus market risk premium, which is a compensation for taking risk at the expense of investing in risk-free assets. The required return (cost of retained earnings) is 15% as shown below. The project's WACC is 9.6%.

Determination of Cost of Capital

Cost of Debt = 7%

Tax rate = 40%

After-tax cost of debt, rD = (1 - 0.4) 7% = 4.2%

Cost of Retained Earnings

Beta = 2.0

Risk-free rate = 5%

Market risk premium = 5%

Cost of equity (retained earnings), rS = Risk-free rate + Beta Market risk premium

= 5 + (2.0 5)

= 5 + 10

= 15%

Weighted Average Cost of Capital = rS S(S+D) + rD (1- T) D(S+D)= (15 50%) + (4.2 50%)

= 7.5 + 2.1

= 9.6%

Decision Metrics

Net Present Value

It gives the difference between the sum of the present values of the project's annual free cash flows and the initial outlay (Brigham & Ehrhardt, 2014). It is obtained by discounting all the project's expected free cash flows at the weighted average cost of capital. The technique presumes that the free cash flows of the project are reinvested at the cost of capital. The criterion in this metric is to compare the sum of the present values of the free cash flows and the initial capital outlay. If the total of the present values of the free cash flows exceeds the initial outlay, the project's NPV is positive and considered viable (Brigham & Ehrhardt, 2014). If the initial cost exceeds the total present value of annual free cash flows, the project's NPV is negative, and the project is not worthwhile. If the decision involves two or more competing projects, the management should select the one with a higher positive NPV. NPV is used for all projects provided the cost of capital can be estimated.

NPV is beneficial since it considers the time value of money. Thus, it accounts for the timing of cash flows. It is crucial since the project's expected free cash flows will accrue over the useful life of the project (Ross, Westerfield & Jaffe, 2008). Besides, it is appropriate since it includes all the project's free cash flows generated during the entire useful life of the project. It is also an absolute metric hence it directly shows the amount of cash the project will make to the company. Furthermore, it is consistent with the goal of shareholder wealth maximization (Brigham & Ehrhardt, 2014). However, its accuracy is reliant on the accuracy of the cost of capital. Sometimes the determination of the cost of capital may be subjective thereby leading a misleading NPV. If the cost of capital is overstated, the NPV will be lower hence the company may wrongly reject a project that is profitable.

Internal Rate of Return

It is the rate at which the NPV of the project is zero (Ross, Westerfield & Jaffe, 2008). The technique assumes that the project's free cash flows will be reinvested at the internal rate of return. The criterion under this tool is to accept an investment whose IRR is higher than the cost of capital and reject investments that generate a lower IRR than the company's cost of capital. IRR may be preferred when comparing projects of unequal sizes. A small project may be more profitable than a large project.

IRR is also beneficial since it takes into account the timing of cash flows and incorporates all the project's free cash flows. However, IRR may be misleading when comparing investments since it is a relative and not an absolute measure (Baker & English, 2011). Besides, its assumption of IRR as the reinvestment rate is unrealistic and unreasonable. It is because the IRR is mostly unreasonably high and not achievable (Ross, Westerfield & Jaffe, 2008). For instance, the IRR for this project is 48.63%, which seems unrealistically high. It also gives multiple values, especially when dealing with unconventional cash flows.

Modified Internal Rate of Return

It is similar to IRR but uses terminal cash flows instead of the annual free cash flows. It is an improvement of IRR and assumes that a company reinvests the project's free cash flows at the cost of capital (Ross, Westerfield & Jaffe, 2008). It is suitable for comparing alternative investments with equal sizes.

Payback Period

It is the duration a project takes to generate sufficient free cash flows to recover the initial outlay. If an investment has even cash flows, the payback period is determined by dividing the initial cost by the annual free cash flows. In this case, the project has varying free cash flows. Thus, we use the cumulative flows (Baker & English, 2011). Projects with shorter payback periods are preferred to those with longer payback periods. It ignores the timing of cash flows as well as the free cash flows generated beyond the payback period. It should be used when evaluating small projects that do not require complex analysis.

Discounted Payback Period

It shows the number of years a project takes to break-even. It discounts the free cash flows and calculates how long the project will accumulate sufficient discounted cash flows to recoup the initial outlay (Baker & English, 2011). It is beneficial since it considers the time value of money. However, it ignores the free cash flows the project makes after the payback period.

Capital Budgeting Decision Model

Table 1: Capital Budgeting Decision Model

Source: Author

As shown in the above model, the project's NPV is positive. Besides, its IRR and MIRR are greater its WACC of 9.6%. It also has a short payback and discounted payback periods. The two payback periods are shorter than the project's useful life. The above metrics imply that the project is viable. Therefore, the company should implement the project.

NPV v. IRR

NPV is the superior metric and should be used at the expense of IRR. It is because its reinvestment rate assumption is reasonable while that of IRR is unreasonable. Besides, NPV gives only one value, unlike IRR that can give multiple values, especially for unconventional cash flows. It also gives an absolute value, unlike IRR which is a relative metric. Thus, the two methods should be used together, but if they give conflicting results, the NPV should be applied.

Sensitivity Analysis

As shown below, the project's NPV is highly sensitive to changes in the selling price. The NPV declines if the selling price falls to $2.00 and becomes negative if the price decreases to $1.90. This implies that the company should not lower the selling price below $2.00 as the project will no longer be viable.

Figure 1: Sensitivity Analysis

Source: Author

References

Baker, H., & English, E. (2011). Capital budgeting valuation. Hoboken, N.J.: J. Wiley & Sons.

Brigham, E., & Ehrhardt, M. (2014). Financial management. Mason (Ohio): South-Western Cengage Learning.

Ross, S., Westerfield, R., & Jaffe, J. (2008). Corporate finance. Boston: McGraw-Hill/Irwin.

Cite this page

Finance Essay Example: Assessment of Relevant Cash Flows. (2022, May 31). Retrieved from https://speedypaper.com/essays/assessment-of-relevant-cash-flows

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Free Essay on the Views of Langston Hughes on America

- Essay Sample on the Succesful Individual

- The Corrections System in the United States Is Failing - Free Essay

- Dissertation Abstract Example on Servant Leadership

- Explanations of How Love Crosses Class Lines - Free Paper with the Article Analysis

- Personal Statement Essay Sample: Information Security

- Stars and Culture Essay Sample

Popular categories