| Type of paper: | Essay |

| Categories: | Company Management United States Society |

| Pages: | 3 |

| Wordcount: | 791 words |

Fiscal policy encapsulate the pragmatic use of spending and taxation by the government to substantively influence the economy. The use of fiscal policies is heightened by John Keynes, who articulated that the government can do the changes in the performance of the economy through adjusting the taxes and the government spending.

The aims of government spending

The U.S and other capitalist countries substantively rely on the free market system to pragmatically direct resources to efficient use, produce the goods needed and allocate the final product CITATION Arg131 \l 1033 (Argy, 2013). However, this is not the best way to achieve economic goals, and thus, government spending is used to exercise some influence over the private economy. This is achieved through;

The redistribution of income because the market even if it allocates productive resources efficiently it may fail to satisfy the preferences of the citizens for greater economic equality.

Correction of the imperfect pricing by the market which is achieved through direct market regulation, use of taxes and subsidies

Provision of goods and services that the private markets cannot provide such as national defense.

Stabilization of the economy when it runs off course.

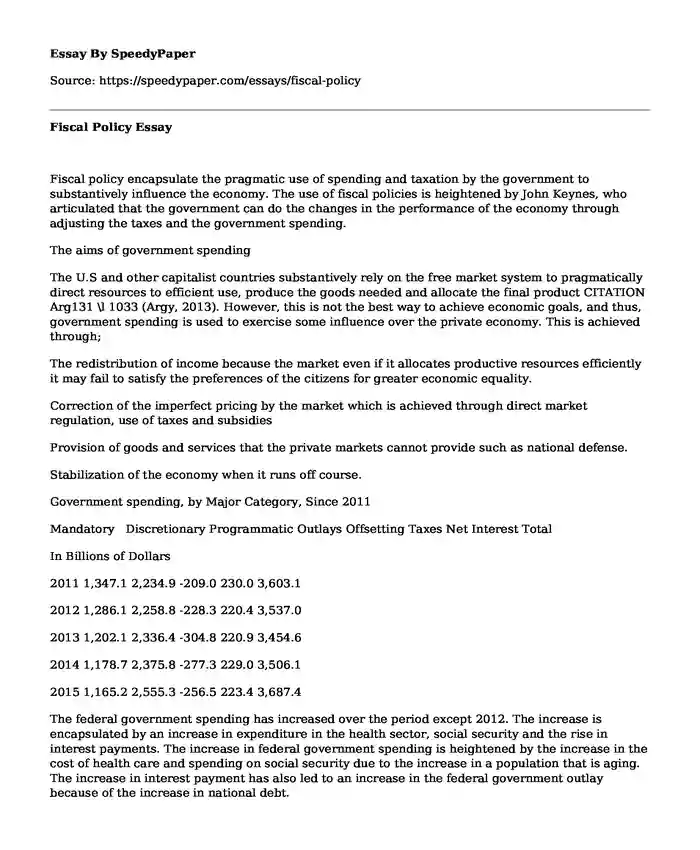

Government spending, by Major Category, Since 2011

Mandatory Discretionary Programmatic Outlays Offsetting Taxes Net Interest Total

In Billions of Dollars

2011 1,347.1 2,234.9 -209.0 230.0 3,603.1

2012 1,286.1 2,258.8 -228.3 220.4 3,537.0

2013 1,202.1 2,336.4 -304.8 220.9 3,454.6

2014 1,178.7 2,375.8 -277.3 229.0 3,506.1

2015 1,165.2 2,555.3 -256.5 223.4 3,687.4

The federal government spending has increased over the period except 2012. The increase is encapsulated by an increase in expenditure in the health sector, social security and the rise in interest payments. The increase in federal government spending is heightened by the increase in the cost of health care and spending on social security due to the increase in a population that is aging. The increase in interest payment has also led to an increase in the federal government outlay because of the increase in national debt.

Revenues, by Major Source, Since 2011

In Billions of Dollars

IndividualIncome Taxes Payroll Taxes CorporateIncome Taxes Excise Taxes Estate andGift Taxes Customs Duties Miscellaneous Receipts Total

2011 1,091.5 818.8 181.1 72.4 7.4 29.5 102.8 2,303.5

2012 1,132.2 845.3 242.3 79.1 14.0 30.3 106.8 2,450.0

2013 1,316.4 947.8 273.5 84.0 18.9 31.8 102.6 2,775.1

2014 1,394.6 1,023.5 320.7 93.4 19.3 33.9 136.1 3,021.5

2015 1,540.8 1,065.3 343.8 98.3 19.2 35.0 146.3 3,248.7

The federal government revenues encompass an increase from 2011 to 2015. The increase in revenues has been felt due the reforms implemented on the federal income tax. The principles encapsulated in these reforms ranges from cutting inefficient and unfair tax breaks, observing the Buffet Rule that substantively enhances tax fairness and the increase in job creation and growth.

Impact of these fiscals policies to the U.S economy

Through the use of expansionary fiscal policies that is higher government spending and lowering taxes will effectively raise the demand for goods and services and hence output and prices. The perspective is dependent on the state of the US economy. During a recession, where there is unused productive capacity, and unemployed workers increase in demand leads to more output without the change in the level of prices. At an economy with full employment, prices increase, but there is a minimum impact on total output.

Fiscal policy can be used as a stabilizer because of its ability to affect output which affects aggregate demand. The use of expansionary fiscal policy in times of recession can be used by the federal government thus restoring output at its normal level and creating employment CITATION Goo13 \l 1033 (Goodwin, 2013). When the economy is in the boom cycle thus spiraling inflation, the federal government uses a surplus budget which helps the economy to slow down. However, arguments against the use of fiscal policy as a stabilizer accentuate it is difficult to use it because of the inside lag. The inside lag encapsulates the time there is the need for fiscal policy and the time Congress, and the president implements it.

Fiscal policy changes the burden of future taxes. When the federal government uses the expansionary fiscal policy, it increases the national debt. This has an impact on the future tax plan because the interest on the debt will be paid in future years hence an additional burden to future tax payers.

Fiscal policy has an impact on the exchange rate and the trade balance. In the case of an expansionary fiscal policy, the increase in the interest rate due to government borrowing substantively attracts foreign capital. Foreigners bid up the price of the dollar in an attempt to get dollars to invest which creates an exchange rate appreciation. The appreciation of the dollar makes imports to the US cheaper and the exports to other countries expensive hence a decline in the trade balance.

Fiscal policy leads to a change in the composition of aggregate demand. When the federal government experiences a deficit, it issues bonds to meet some of its expenses and in doing so, it competes with private borrowers hence reducing the fraction of output that is made from private investment.

References

BIBLIOGRAPHY Argy, V. (2013). International macroeconomics: theory and policy. Routledge.

Goodwin, N. N. (2013). Macroeconomics in context. ME Sharpe.

Cite this page

Fiscal Policy. (2019, Sep 16). Retrieved from https://speedypaper.com/essays/fiscal-policy

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Multicultural Education in a Free Essay Sample

- Essay Sample about Community Service for Students

- Free Essay with the Persistent Asthma Case Study

- Ozone Depletion, Free Essay Sample

- Pre-Flexner - Medical Education Essay Sample

- Free Essay on The Origin of The Earth

- Free Essay: America Before and After World War 1

Popular categories