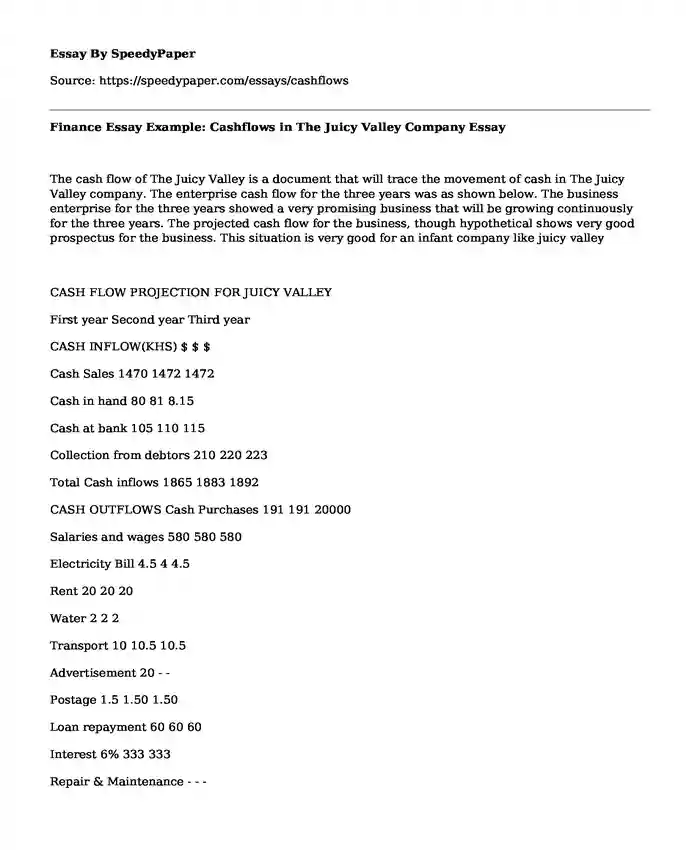

The cash flow of The Juicy Valley is a document that will trace the movement of cash in The Juicy Valley company. The enterprise cash flow for the three years was as shown below. The business enterprise for the three years showed a very promising business that will be growing continuously for the three years. The projected cash flow for the business, though hypothetical shows very good prospectus for the business. This situation is very good for an infant company like juicy valley

CASH FLOW PROJECTION FOR JUICY VALLEY

First year Second year Third year

CASH INFLOW(KHS) $ $ $

Cash Sales 1470 1472 1472

Cash in hand 80 81 8.15

Cash at bank 105 110 115

Collection from debtors 210 220 223

Total Cash inflows 1865 1883 1892

CASH OUTFLOWS Cash Purchases 191 191 20000

Salaries and wages 580 580 580

Electricity Bill 4.5 4 4.5

Rent 20 20 20

Water 2 2 2

Transport 10 10.5 10.5

Advertisement 20 - -

Postage 1.5 1.50 1.50

Loan repayment 60 60 60

Interest 6% 333 333

Repair & Maintenance - - -

Insurance 10 - -

Total Cash flow 907 877.73 887.83

Net Cash Balance C/D 95957.27 1005.27 1004.17

Accumulative Cash 977.27 1962.54 2966.71`

INCOME STATEMENT

Income statement is a financial statement. It is used by business owners and business accountants to depict the financial position of a business. It is also known as the trade, profit and ,losss account. It provides a basis for preparation of other financial statements such as the balance sheet and shareholders equity

It is of importance to any business enterprise. This is because it shows the business profitability index at a given financial period. A financial period is always set by the business owners in our case our financial period begins in January and ends in December.

An income statement has to show flow of cash in the business. It always shows the expenses incurred during the daily operations, the revenue generated from its sales, the loss and gains. However, it does not show the cash receipts or cash disbursed.

An income statement will be of great importance to our Juicy Valley enterprise because it will indicate out project net gains or net losses incurred. The information depicted will then be analyzed. In case of divisions we will be able to identify the causes and take corrective measures to improve on the flaws and maximize n sales and customer satisfaction.

It is of importance to any. The forecasted income statement for the juicy valley will be as shown below. The income statement document will show how revenue is spent and how the profits are made.

Year 1 in $ Year 2 in $ Year 3 in $

SALES 17.69 17.70 17.90

Less cost of sales Opening stock 3000 3500 4000

Add purchases 238.5 239.5 241

Less closing stock 1500 2000 2500

Gross profit 13,804 13,804 13,989

Less expenses Salaries and wages 6960 6960 6960

Rent 240 240 240

Water 26.80 28.80 30.80

Telephone 60.50 60.00 60.50

Electricity 48.00 49.00 50.00

Advertising 960.00 961.00 965.00

Stationery 66.00 961.00 96,5.00

Postage 66.00 66.50 67.50

Transport 18.00 18.00 18.00

Interest 127.60 230.00 140.00

Repairs and maintenance 39.96 39.96 39.96

Loan repayment 720.00 720.00 720.00

Total 9316.86 9327.26 9437.76

Net profit before tax 4487.34 4476.94 4641.44

Less provision for tax 224.367 223.847 222.07

Net profit after tax 4262.973 4253.093 4409.368

Balance sheet is a document showing the financial status business at any given time. A balance sheet is always the first diagnosis of the viability of the business. In most cases the balance sheet is always right in accessing the financial status. The juicy valley enterprise for the first three years promised to be very success full. The balance sheet could be used by the juicy valley proprietor to look for the financial assistance in any financial institution. According to the balance sheet the business is viable and worth investing. It can be deduced that at the end of the first year the assets of the business increased a normal profit could be made. If this forecast is the truth it is good and viable business that can bring back the investment in less than one year

Year 1

FIXED ASSETS

Equipment and facilities

Furnitures and fittings

Motor vehicle

Less acc. Depreciation 5% 3213.65

160.68 300

150

3052.97

Total Fixed Assets 3502.97

Current Assets Stock of raw materials 20000 Stock of finished goods 500 Work in progress 1000 Debtors 2760 Cash at bank 1500 Cash at hand 1000 Total current assets 8760 8760

12262.97

Less current liabilities Financed by owners equity

Add Net profit 6000

4262.97 Long term liabilities

Loan from bank 20000 12262.97

Cite this page

Finance Essay Example: Cashflows in The Juicy Valley Company. (2019, May 15). Retrieved from https://speedypaper.com/essays/cashflows

Request Removal

If you are the original author of this essay and no longer wish to have it published on the SpeedyPaper website, please click below to request its removal:

- Finance Essay Sample: Uses of a Cash Flow Statement

- Essay Sample: Mekong River and Environmental Concerns

- Free Essay Analyzing the Article on Sleeping Pills

- Atomic Bombs and Other Inventions Used in War, Essay Sample

- Essay Example on Principles of Economics and Pension Accounting

- Causal Claims

- Essentials of a Veterinarian - Essay Sample

Popular categories